Winning the battle but losing the war?

The battle:

-- Claudia Sahm vs. Larry Summers

-- Transitory inflation

-- Rate hikes

-- "When will it end?"

The war:

-- Borrower vs. lender

-- Quantitative Tightening

-- No more ZIRP

-- Slower growth

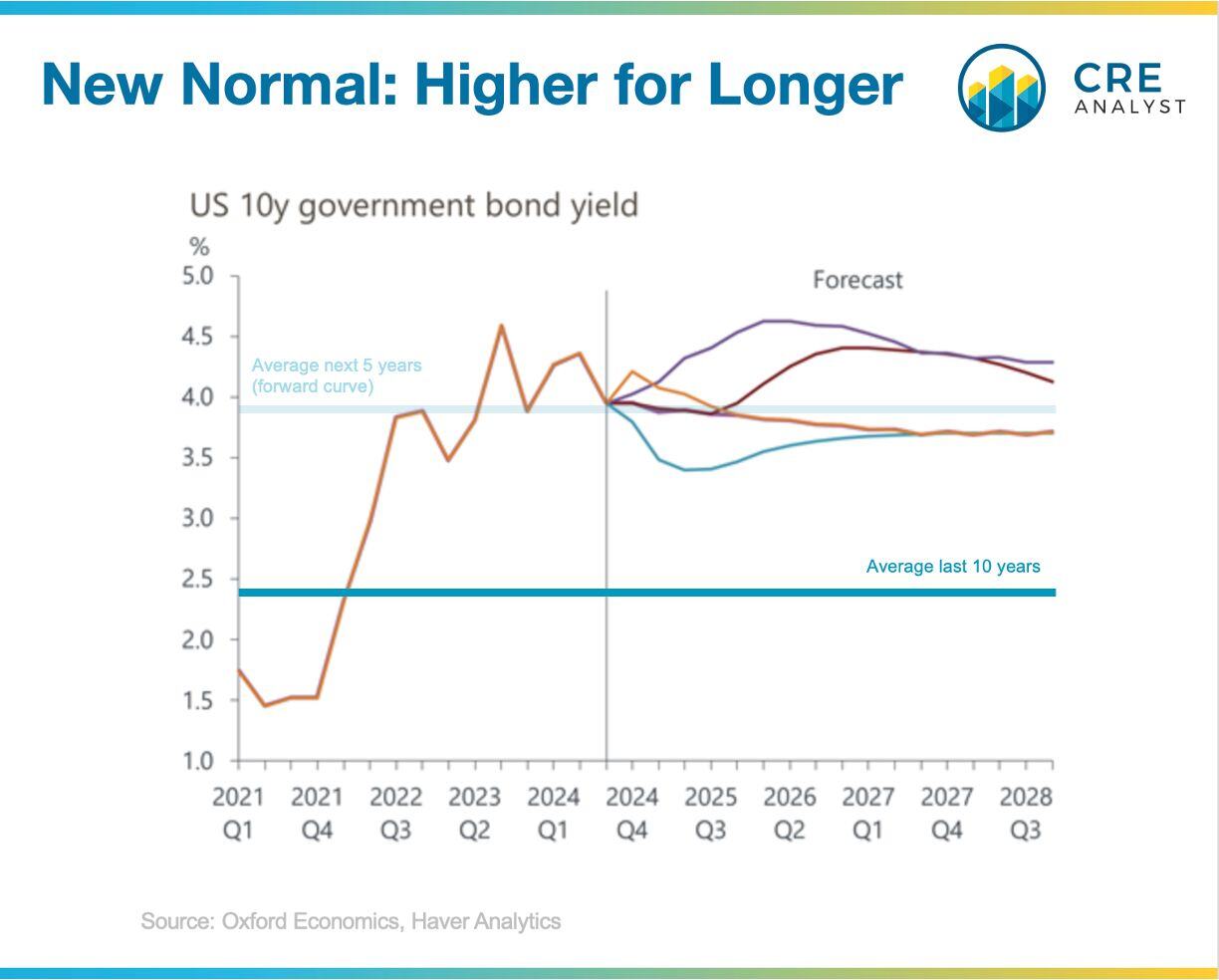

-- 150 bps increase in long-term rates across all scenarios

Today's realities:

Short-term rates may be 50 bps lower next week vs. last week...

...but that floating-rate apartment loan with a 5% debt yield (compared to 5.5% cap rates) is still due next year.

...office buildings are still 20%+ vacancy with very few buyers.

...and there's still only a 50-75 bps spread between development yields and exit cap rates.

COMMENTS