Most investors focus on track records, but the hidden driver of long-term success is...

Alignment

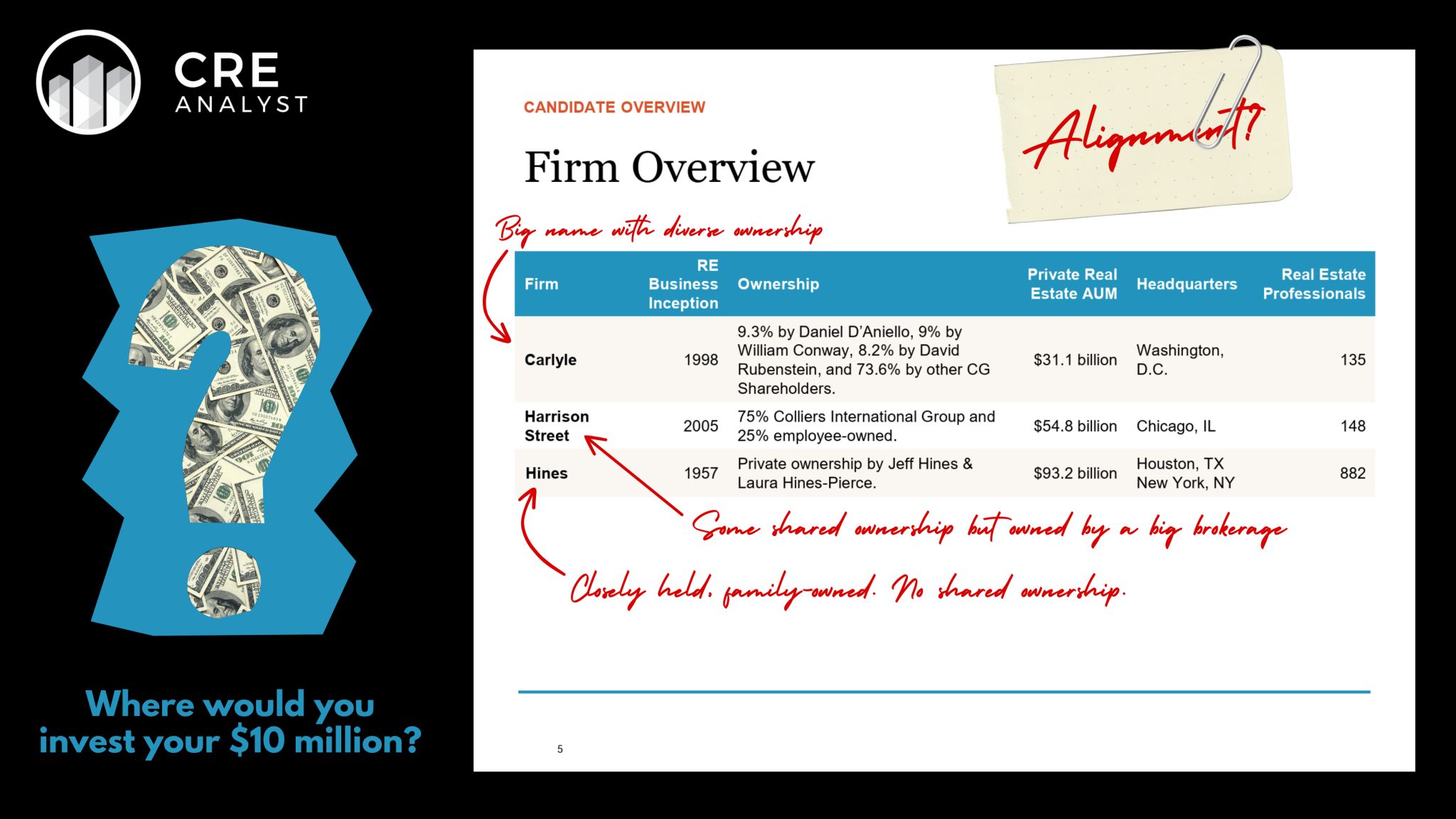

The West Palm Beach Firefighters’ Pension Fund was recently searching for a core plus real estate manager, and its consultant narrowed in on three firms: Carlyle, Harrison Street, and Hines.

Each firm’s income-oriented strategy had differences, but what stood out to us was how different their ownership structures were.

These differences could meaningfully affect long-term alignment with investors, but first, a few quick background thoughts...

Investment team alignment: As a passive investor, you want to know that the people making the decisions have skin in the game. Some combination of co-investment and profit-sharing usually achieve this.

Platform stability: Since core plus strategies are perpetual in nature, you also want to know that the team managing your investment today will still be there tomorrow. This comes down to platform value, i.e., how the ownership structure affects long-term retention and incentives.

Here’s how these three firms compare...

---- Carlyle ----

Ownership is spread across key team members, but its also spread across founders and partners in more traditional private equity businesses. Meaning broader LBO market dynamics could influence incentives and retention.

---- Harrison Street ----

Key team members hold 25% ownership, while Colliers (a global brokerage) owns 75%, which raises a key question: can the fund's management team really be insulated from global brokerage shifts? e.g., could the Harrison Street core plus team's comp be affected by stress in brokerage?

---- Hines ----

A family-owned business, with full ownership in the hands of Gerald Hines’s son and granddaughter. But with so many offices, strategies, and capital partners, how much of a priority is this particular investment strategy to them?

---- Takeaways ----

Ownership structure isn’t a headline metric, but it’s arguably one of the strongest indicators of how an investment team will behave over time.

...less important on value-oriented strategies, but when the investor's goal is to clip coupons over long periods of time, platform ownership creates some challenges.

Notably, there's no silver bullet solution for solving these challenges. Firms, like the three outlined above, have radically different ways of approaching long-term alignment.

Which structure do you think best aligns with long-term investors?

If you were a retired West Palm firefighter/pensioner, which approach would you prefer?

COMMENTS