This may be the most boring story in real estate.

It may also be the most consequential.

"It's like being on a runaway train that suddenly slams on the brakes. Everything screeches to a halt, and you're left wondering what just happened."

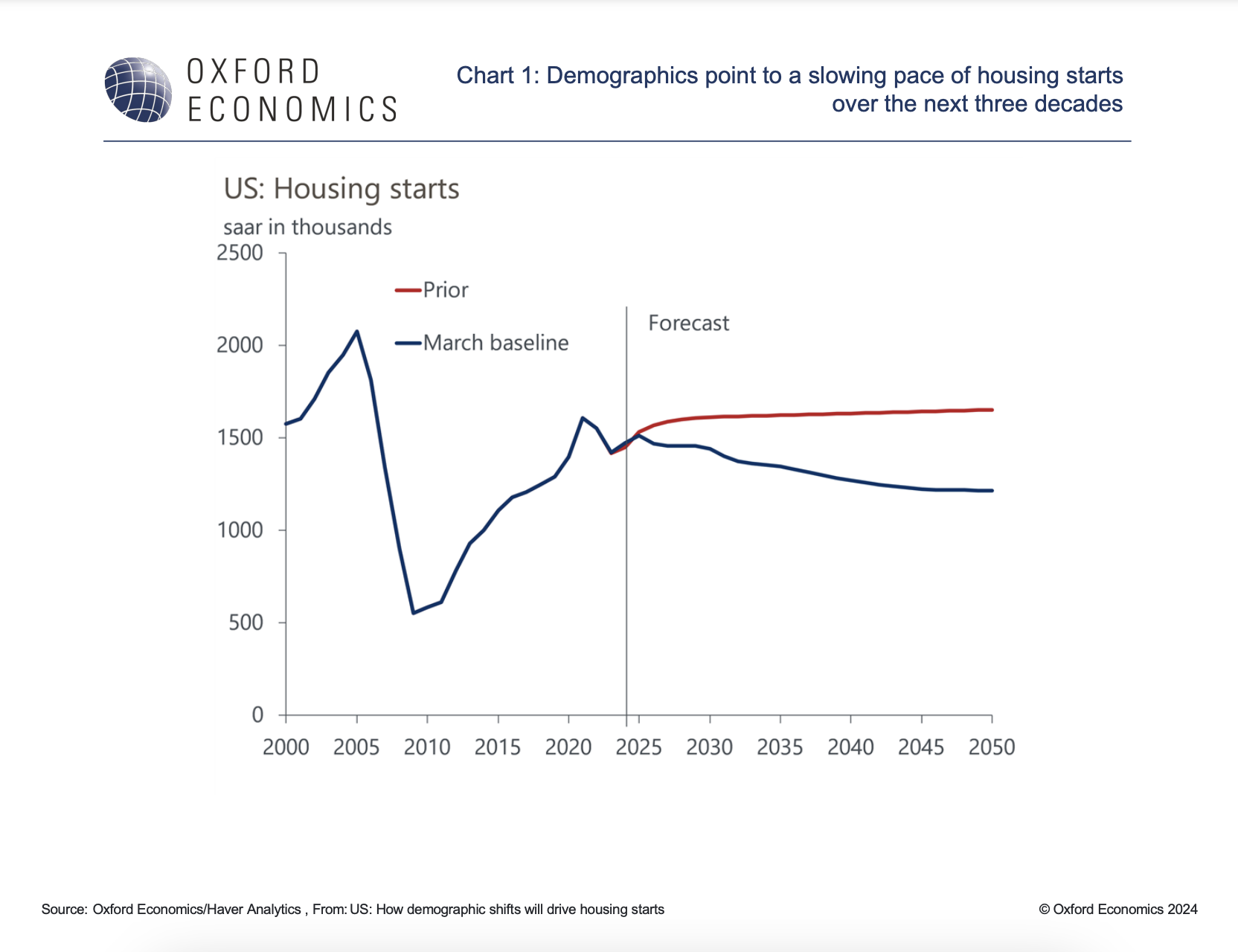

Oxford Economics, a leading research and forecasting firm, recently concluded a research brief with: "...we revised down substantially our long-term forecast for housing starts to better align it with our updated population projections."

For economists, this may not be that jarring, but real estate careers depend on growth. And the idea of growth slowing meaningfully should raise the eyebrows of every real estate player.

Oxford has done what others haven't by attempting to quantify the effects of slower growth across a range of scenarios. None of them are great for real estate investors.

---- Slower growth ----

"The latest release of the population projections by the Census Bureau, the first since 2017, offers a dour view of future population growth, with a combination of lower birth rates, higher death rates, and slower net migration driving a large divergence between its 2017 forecasts and our current forecast."

---- What's happening? ----

"Birth rates have steadily declined since the 1980s, but the downturn has been particularly stark since 2007, with birth rates falling every year since."

---- Key rebound driver: immigration ----

"As the native-born population ages, immigration will account for a rising share of population growth, making it crucial to growth in the labor force and the economy's long-term potential over the next several decades."

"Based on our population projections, immigration will account for close to 100% of population growth by 2050."

---- Fewer housing starts ----

"Our March baseline forecast includes a sizable downward revision to our long-term forecast for US housing starts. After topping out at a seasonally adjusted rate of just over 1.5mn in 2025, we expect the annual pace of housing starts to begin a gradual descent to 1.2mn by 2050."

---- Implications for real estate investors ----

Less demand from buyers and renters could send a shockwave through the infrastructure that builds and sells every form of housing from detached single-family to high-rise multifamily.

COMMENTS