A major milestone for CBRE and the real estate industry?

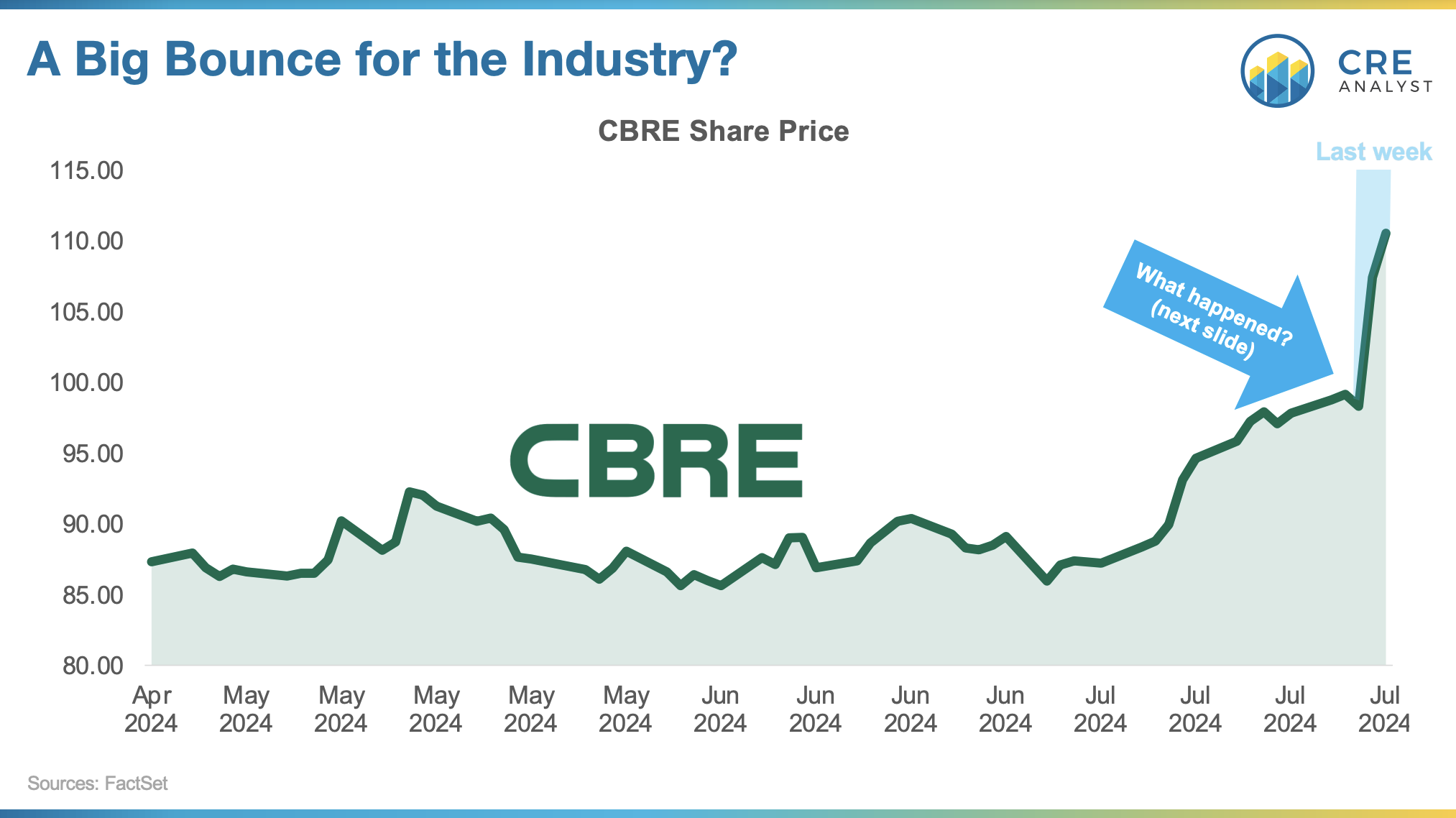

CBRE reported 2Q earnings last Thursday, triggering a 12% surge in CBRE's stock price and a $3.5 billion increase in CBRE's market capitalization.

---- Lots of good news ----

Why did the market respond so favorably?

1. Leasing revenue (the 800 lb gorilla in CBRE's businesses) outperformed expectations.

2. Investment sales revenue continues to fall (down 3%) but seems to have stabilized.

3. Project management and facilities management continue to grow meaningfully, along with topline revenue from M&A activity.

4. Development profits are rebounding faster than previously expected, especially from data centers in the Trammell Crow business.

---- A simpler take ----

CBRE's size and reach make it a barometer for the industry, so we follow its revenue streams (and overall business lines) closely.

In some ways, CBRE is much more than a brokerage. It has some pretty complicated businesses.

However, 60-70% of CBRE's advisory revenue comes from brokerage, and here's how these brokerage revenues have changed YoY since the pandemic recovery...

Q2 2021 70%

Q3 2021 68%

Q4 2021 57%

Q1 2022 46%

Q2 2022 26%

Q3 2022 0%

Q4 2022 -27%

Q1 2023 -25%

Q2 2023 -30%

Q3 2023 -24%

Q4 2023 -4%

Q1 2024 1%

Q2 2024 7%

So why has the stock market received CBRE's earnings so positively?

...because CBRE's most recent earnings suggest brokerage activity has hit a bottom.

---- Any bad news? ----

CBRE entered this downturn with an industry-leading cash stockpile. The firm had a unique opportunity to establish itself as a CRE juggernaut instead of just a brokerage juggernaut.

What did CBRE do with all that cash? Stock buybacks and facility management M&A.

What could it have done with that cash? Seeded more funds in its higher-margin investment management and/or higher co-invests in its development deals.

Good news for CBRE: No one will know how much it could have advanced its lead.

---- We stand corrected! ----

In our 2024 predictions, we noted that analysts had relatively strong outlooks for CBRE's revenue targets. We predicted that "brokerage revenue would disappoint this year, led by CBRE."

CBRE missed revenue estimates last quarter, but we're happy to report that this quarter blew up our prediction. ...and for the sake of our brokerage friends' commission checks, we hope the rest of 2024 stays on this track.

Does CBRE's strength extend to other brokerages? We'll know soon. They report 2Q performance over the next few weeks. More to come...

COMMENTS