Is CBRE gearing up for a game-changing merger?

You're the world’s largest real estate firm.

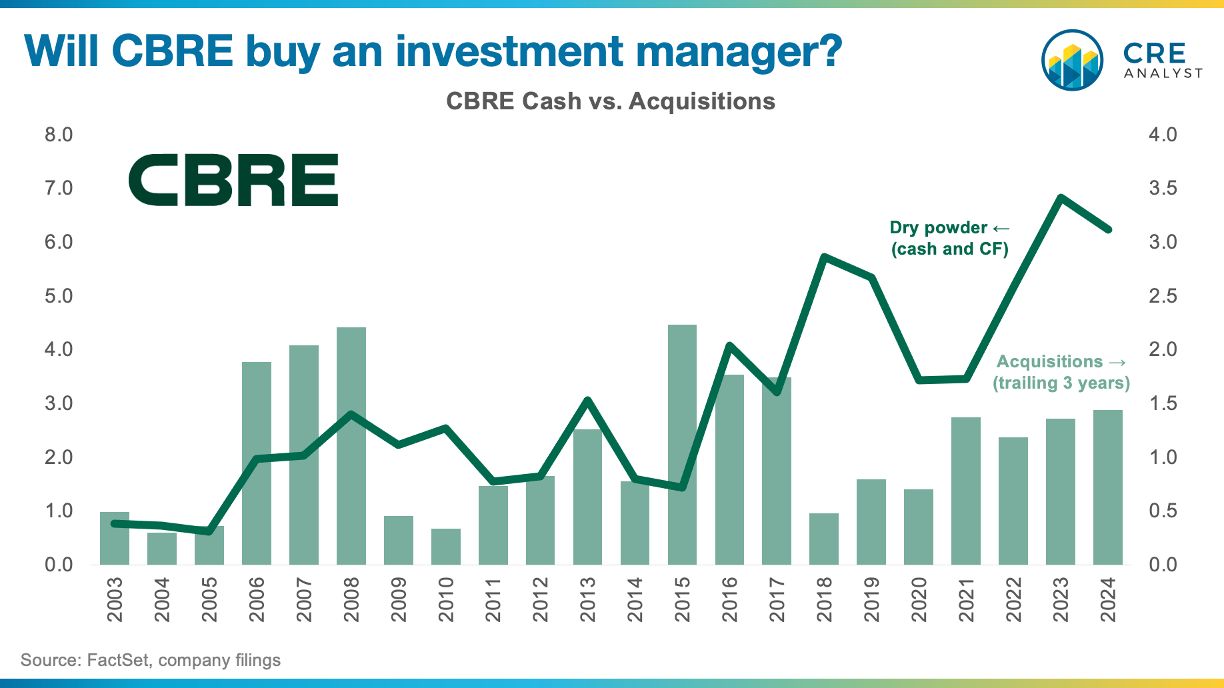

You’ve got billions in cash.

Your stock is near all-time highs.

You’re trying to supercharge your fund management business.

...but fundraising is brutally slow.

What do you do?

You buy an investment manager.

---- Setting the stage? ----

December 2024:

CBRE names Adam Gallistel—former head of real estate at one of the largest sovereign wealth funds—as co-CEO of CBRE Investment Management. He brings deep relationships across the allocator and manager ecosystem.

January 2025:

Bob Sulentic gets explicit: “Our Real Estate Investments segment is underappreciated… we expect it to become one of the leading contributors to our long-term growth.”

February 2025:

Earnings call: Trammell Crow reportedly holds nearly $1B in embedded profits, likely to be realized soon.

March 2025:

CBRE restructures its segments. Trammell Crow Company and CBRE Investment Management now stand alone under “Real Estate Investments.”

---- The logic ----

CBRE generates massive amounts of cash, but, with the stock trading near peak levels, are buybacks still attractive?

CBRE has the cash to easily:

Acquire scale

Acquire capability

Acquire talent

M&A just makes sense.

...especially now.

Midsize managers know they can't compete with Blackstone and Brookfield, and many of them are too big to be boutique.

Prediction: CBRE makes a strategic investment manager acquisition in 2025.

PS -- This post is for educational purposes only. We share daily insights with students and teammates to sharpen thinking around real estate trends and fundamentals. Want to build key industry skills? DM us.

COMMENTS