Would you rather have a 20% IRR or a 2.0x multiple?

Most investors say “both.”

But let’s be honest: IRR gets the spotlight.

Why?

-- Easy to track

-- Easy to benchmark

-- Fits neatly into consultant reports

-- Drives promotes for GPs

-- Drives bonuses for LPs

---- Red flag 1 ----

Higher IRR ≠ more money

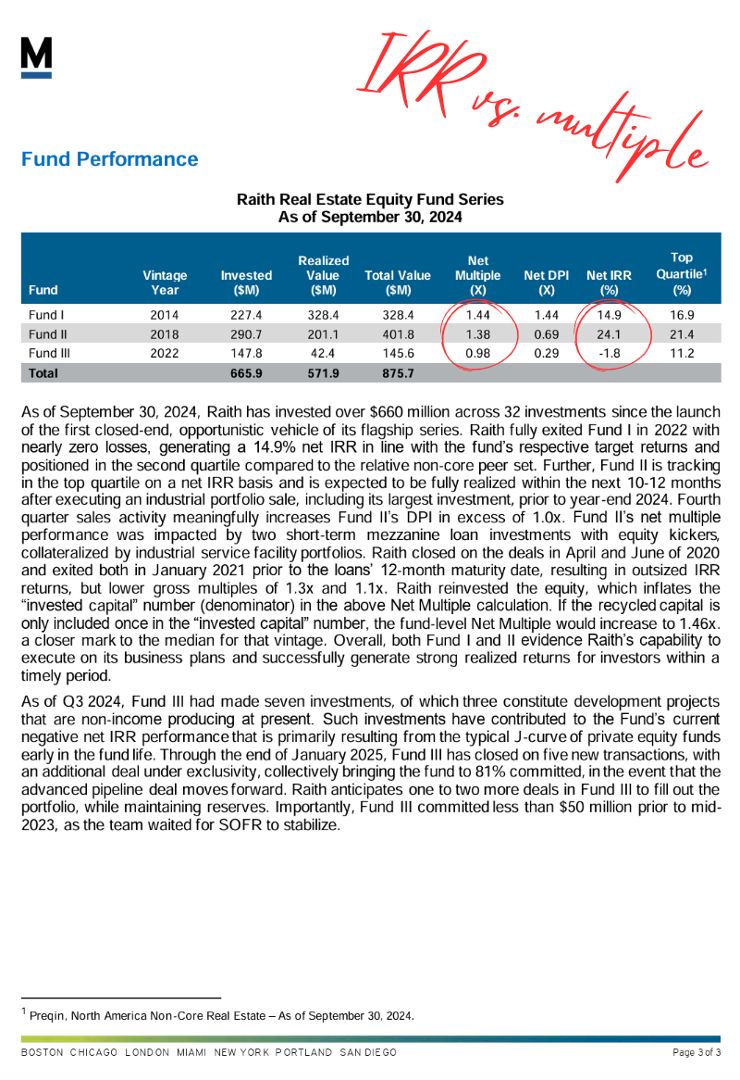

A 20%+ IRR on a 1.5x in 2 years feels great.

But a 2.0x over 5 years quietly creates more wealth to the LP.

Some LPs (e.g., endowments, sovereign wealth funds) opt for total return over speed. To them, how much you make > how fast you make it.

---- Red flag 2 ----

Higher IRR = more risk

IRR-based thinking encourages short holds, quicker flips, and risk-taking.

Here's a realistic example...

Fund I: crushed it

Fund II: also great

Fund III: solid

Fund IV: ...meh

Fund V: still raising money

By the time performance softens, capital momentum is locked in. How many fund managers would say no to re-ups from those early funds? Or to new money rolling in thanks to the prior funds' outperformance? Not many.

---- No silver bullets ----

In our FastTrack program, we break down real estate return metrics—IRR, multiples, equity yield, and more—so you know when to use each one and why it matters.

We also negotiate JV promote structures so participants understand how incentives shape behavior.

DM us if this sounds interesting. May 2025 cohort is enrolling now.

COMMENTS