I see the bad moon a-risin'

I see trouble on the way...

---- Trigger ----

Multifamily asset pricing was significantly overheated during the Covid rebound, especially for class B and C properties. About 30-40% of the sector traded around the peak, and values have since fallen by 20-25%, wiping out 50%+ of investor equity (on paper).

---- Balance sheets in focus ----

The fallout has primarily been balance sheet and/or debt-related:

-- Floating rate pressures

-- Cap costs

-- Short-term maturities

-- Blend and extend

-- Rising cap rates

Since NOIs have held up and sellers have avoided selling properties, widespread equity erosion has been accrued but not recognized.

[i.e., if a tree falls in the woods... if I buy at 3% cap rates then interest rates spike but my NOI holds up, then I refuse to sell and my loan doesn't mature for another few years.]

---- Emerging risks? ----

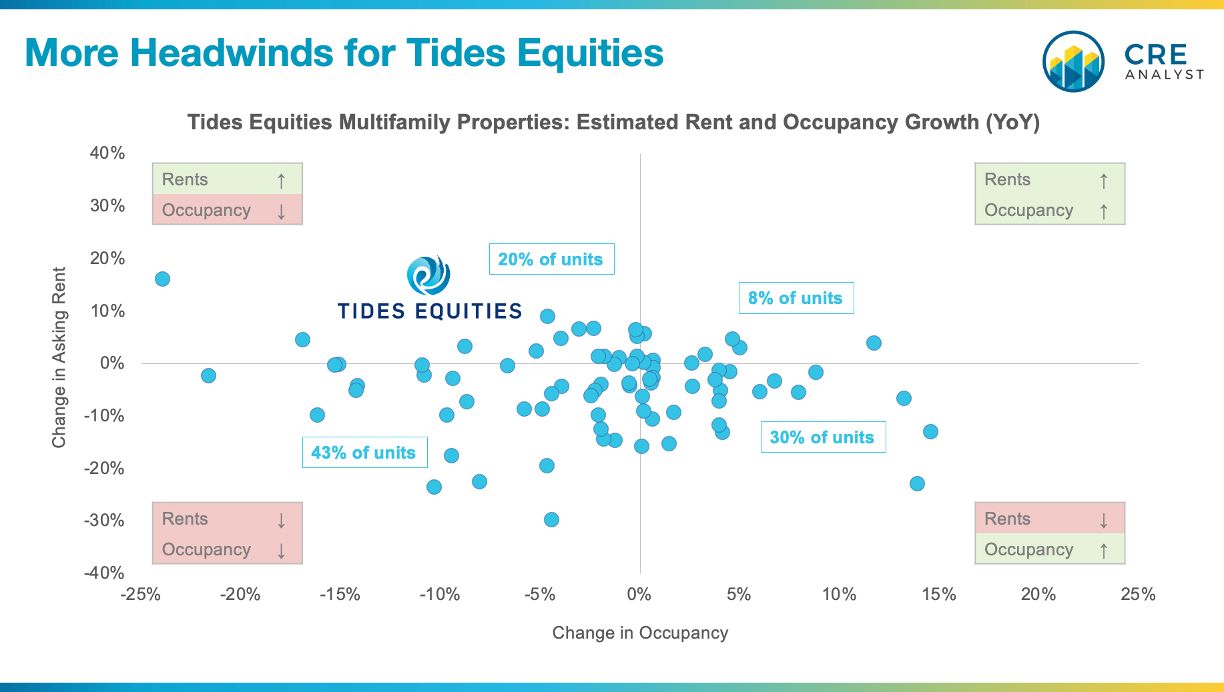

No Class B/C sponsor has captured more headlines than Tides Equities, and if the firm (which amassed $7B of properties near the peak) is an accurate barometer, more problems could be emerging.

We started following Tides' properties about two years ago, and although we don't have complete coverage, rents and occupancies seem to be moving in the wrong direction for 90% of the Tides portfolio.

---- Brace for a wave of defaults? ----

This performance erosion could also be an early indicator of a near-term spike in defaults.

Lenders often extend loan maturities as long as property income is stable and covers debt service.

Similarly, borrowers are typically willing to hang on when they don't have to come out of pocket to fund debt service, even in the face of strained LTVs.

...but when leverage AND coverage are strained, you can expect to see more defaults and you probably won't have to wait until loan maturity to see defaults begin to mount.

---- Takeaways ----

If Tides is a decent indicator, Class B and C multifamily properties may be moving in the wrong direction.

We're all fatigued by the headlines, but this suggests that we're in the early innings of multifamily loan distress and problems could emerge quickly.

PS - What property type has the highest historical CMBS default rate?

...multifamily at 14%.

COMMENTS