How to make 7% in a 4% market...

Lend $100 to a developer at 4%.

Borrow $75 at 3.0%.

Simple as can be as long as your developer performs.

If your borrower hits a snag, you'll try to remedy it by restructuring the loan you provided, but your lender will require you to provide safer collateral (i.e., a new, better loan and/or cash out of your pocket.)

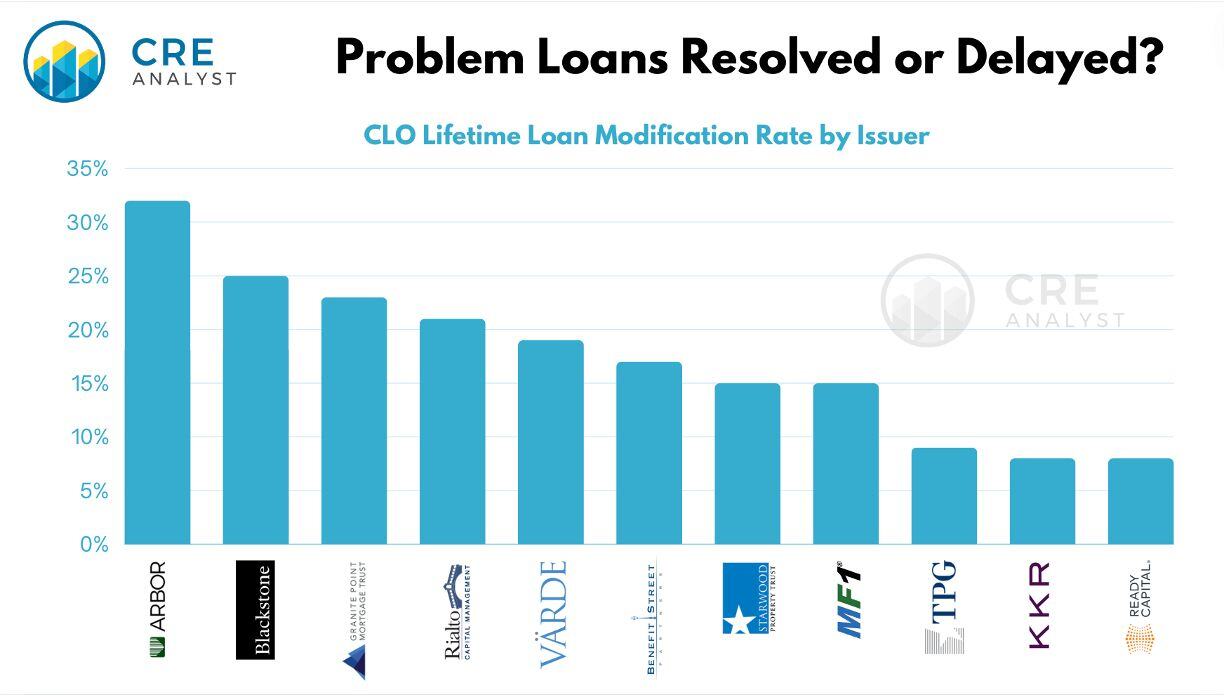

Problem loan rates are mounting in the CRE-CLO*** space, as are collateral substitutions. But performance isn't evenly distributed across sponsors.

*** CRE-CLOs are a popular financing vehicle for lenders. Rather than going to a single, traditional source (e.g., a bank.) They pool loans and sell senior bonds on those loan pools.

COMMENTS