The rich get richer: A common theme?

Homebuilding is an interesting cousin to commercial real estate. And although it has some complications, it seems like a pretty simple business...

1. Preserve and drive operating margin

2. Turn inventory as quickly as possible

3. Maximize sales and market share

The last four years in homebuilding in a nutshell...

-- 2020: "A pandemic? This could be really bad."

-- 2021: "More people want houses. This is great."

-- 2022: "Higher interest rates? This could be really bad."

-- 2023: "Rate buydowns but solid sales. This is great."

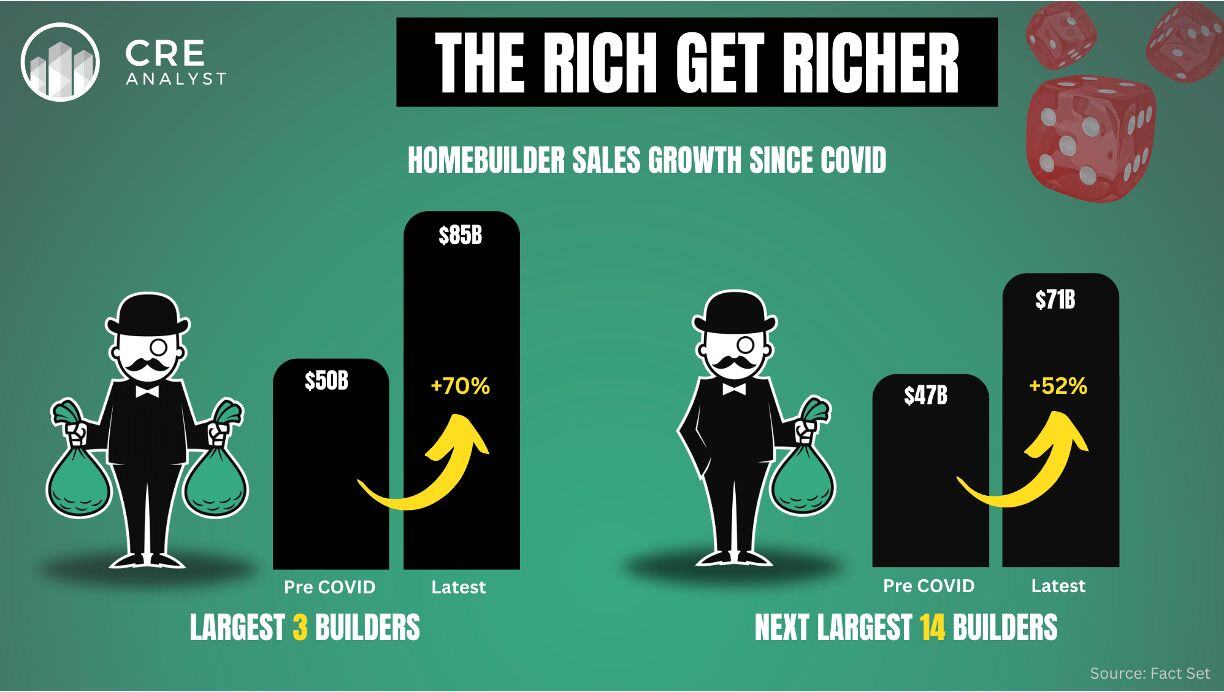

But an interesting trend has emerged over the last few years...

The biggest builders are clearly separating from the pack.

Three builders--DR Horton, Lennar, and Pulte--account for 55% of the sales from the top 17 public builders vs. 52% share in 2019. And their operating margins simultaneously increased from 21.5% to 26.3%.

Sidenote: Why do we track the top 17? Because they each have at least a billion in annual sales.

A quick comparison of some of the public real estate-related sectors we follow...

----- REITs -----

Goal: Give shareholders perpetual income via rents

Big trend: Higher interest rates give investors better alternatives

Rich getting richer? Largest 13 REITs = 50% of the sector (w/162 REITs).

----- Investment managers -----

Goal: Give private investors solid returns for share of profits

Big trend: Slower fundraising

Rich getting richer? Blackstone could have bought every distressed deal in the U.S. over the last year with less than 5% of its dry powder.

----- Brokers -----

Goal: Rent intermediary talent on a temporary basis

Big trend: Fewer deals, cost cutting

Rich getting richer? CBRE and JLL now make up more than 75% of public brokerage revenue.

----- Homebuilders -----

Goal: Build and sell fast, max sales and margin

Big trend: Continued sales with tax via rate buydowns

Rich getting richer? 3 out of the top 17 builders account for 55% of sales with growing margins.

----- Banking -----

Goal: Lend short and pray depositors don't want their money back soon

Big trends: Falling deposits, unrealized losses

Rich getting richer? Of the 4,000+ banks in the U.S., the largest 15 banks account for 75% of deposits.

Do you see this trend in your corner of the industry?

Would you rather work at a dominant company or be slugging it out in a smaller shop?

COMMENTS