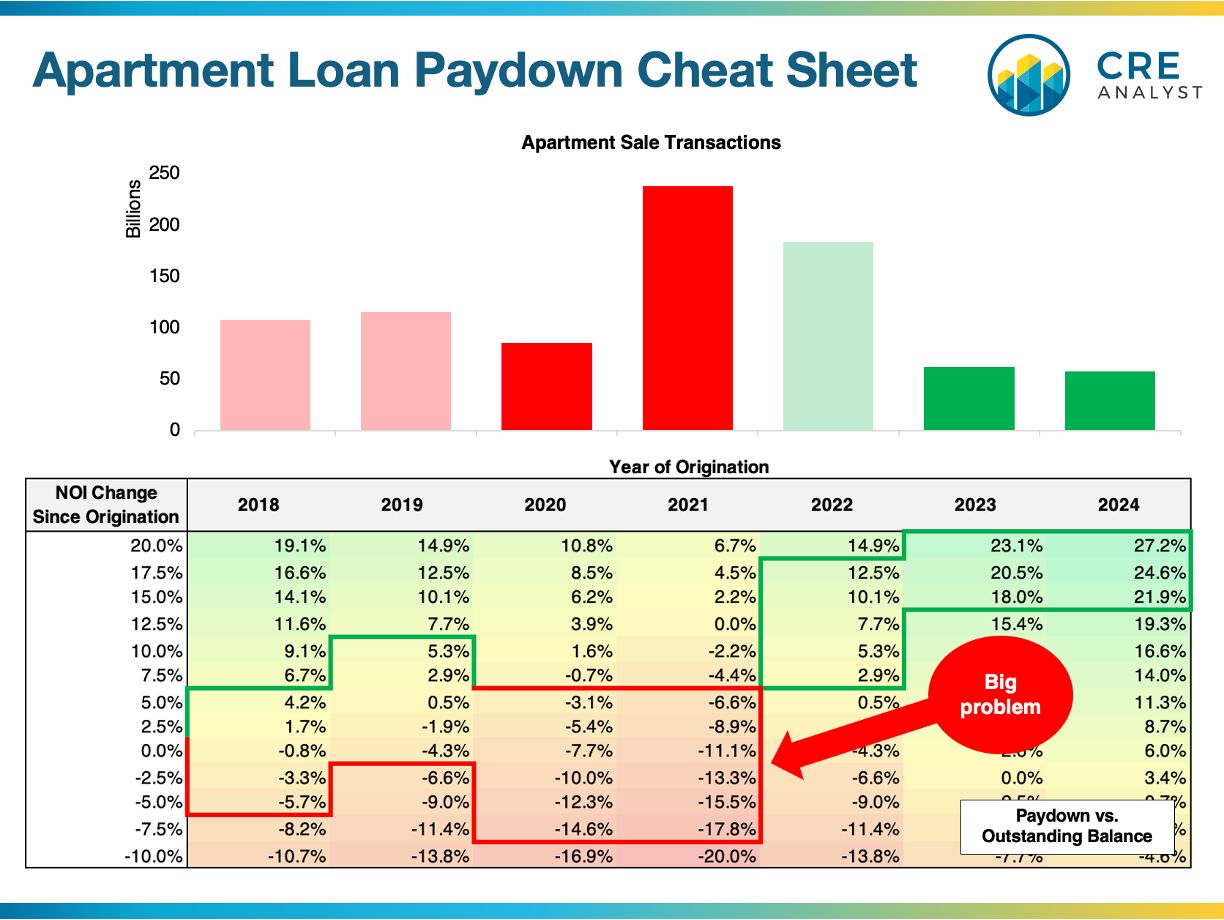

Facing a loan maturity? Here's a paydown cheat sheet.

How much will you have to come up with to save your property?

The answer to this question is largely a function of property performance (how much has NOI increased or decreased since you bought it), lender underwriting requirements, and interest rates.

Let's say you borrowed $57M in 2021 to buy an apartment project...

-- $5M of NOI

-- $57M acquisition financing

-- 6.5% debt yield at origination

-- Sub 4% coupon

-- Matures later this year

-- NOI is down 2.5% thanks to insurance costs

You'll be able to finance the property, but since underwriting standards have shifted and coupons are up, the property can't cover your current loan at today's underwriting standards.

How big is the funding gap?

Assume current NOI is $4.9M, that lenders want 1.35x DSCR with 30-year amortization, and that current coupons are around 6.15%. The most debt service the property can carry is $3.6M a year, which equates to $49-50M in loan proceeds.

Your options...

1. Sell your property to pay off the loan at maturity.

2. Come up with $7-8M (13% of the current loan) to bridge the difference between what the old lender gave you and what the new lender is willing to refinance.

3. Negotiate an extension with the current lender.

For better or worse, your current lender probably isn't stupid. They realize you have value to protect and will figure out a way to stay in the mix. They also aren't getting paid to provide you with 80%+ LTV financing, have no upside, and may have a regulator in their ear, so expect them to push pretty hard.

Welcome to 2025.

A sliver of good news: if the scenario above sounds familiar, you're not alone. $300B+ of apartments transacted at super low rates and relatively loose underwriting standards.

Note 1: This sensitivity analysis was inspired by a discussion recently posted by Brandon Roth. Worth a follow if you appreciate capital markets insights.

Note 2: The highlighted boxes in the sensitivity table show where paydowns would likely be if property NOIs have trended in line with apartment REIT NOI growth.

How much will you have to come up with to save your property?

The answer to this question is largely a function of property performance (how much has NOI increased or decreased since you bought it), lender underwriting requirements, and interest rates.

Let's say you borrowed $57M in 2021 to buy an apartment project...

-- $5M of NOI

-- $57M acquisition financing

-- 6.5% debt yield at origination

-- Sub 4% coupon

-- Matures later this year

-- NOI is down 2.5% thanks to insurance costs

You'll be able to finance the property, but since underwriting standards have shifted and coupons are up, the property can't cover your current loan at today's underwriting standards.

How big is the funding gap?

Assume current NOI is $4.9M, that lenders want 1.35x DSCR with 30-year amortization, and that current coupons are around 6.15%. The most debt service the property can carry is $3.6M a year, which equates to $49-50M in loan proceeds.

Your options...

1. Sell your property to pay off the loan at maturity.

2. Come up with $7-8M (13% of the current loan) to bridge the difference between what the old lender gave you and what the new lender is willing to refinance.

3. Negotiate an extension with the current lender.

For better or worse, your current lender probably isn't stupid. They realize you have value to protect and will figure out a way to stay in the mix. They also aren't getting paid to provide you with 80%+ LTV financing, have no upside, and may have a regulator in their ear, so expect them to push pretty hard.

Welcome to 2025.

A sliver of good news: if the scenario above sounds familiar, you're not alone. $300B+ of apartments transacted at super low rates and relatively loose underwriting standards.

Note 1: This sensitivity analysis was inspired by a discussion recently posted by Brandon Roth. Worth a follow if you appreciate capital markets insights.

Note 2: The highlighted boxes in the sensitivity table show where paydowns would likely be if property NOIs have trended in line with apartment REIT NOI growth.

COMMENTS