You have $25M and want real estate exposure. Here are 3 respected opportunities. Which one are you picking? Fee structure comparison below...

---- Core, diversified ----

Fund:

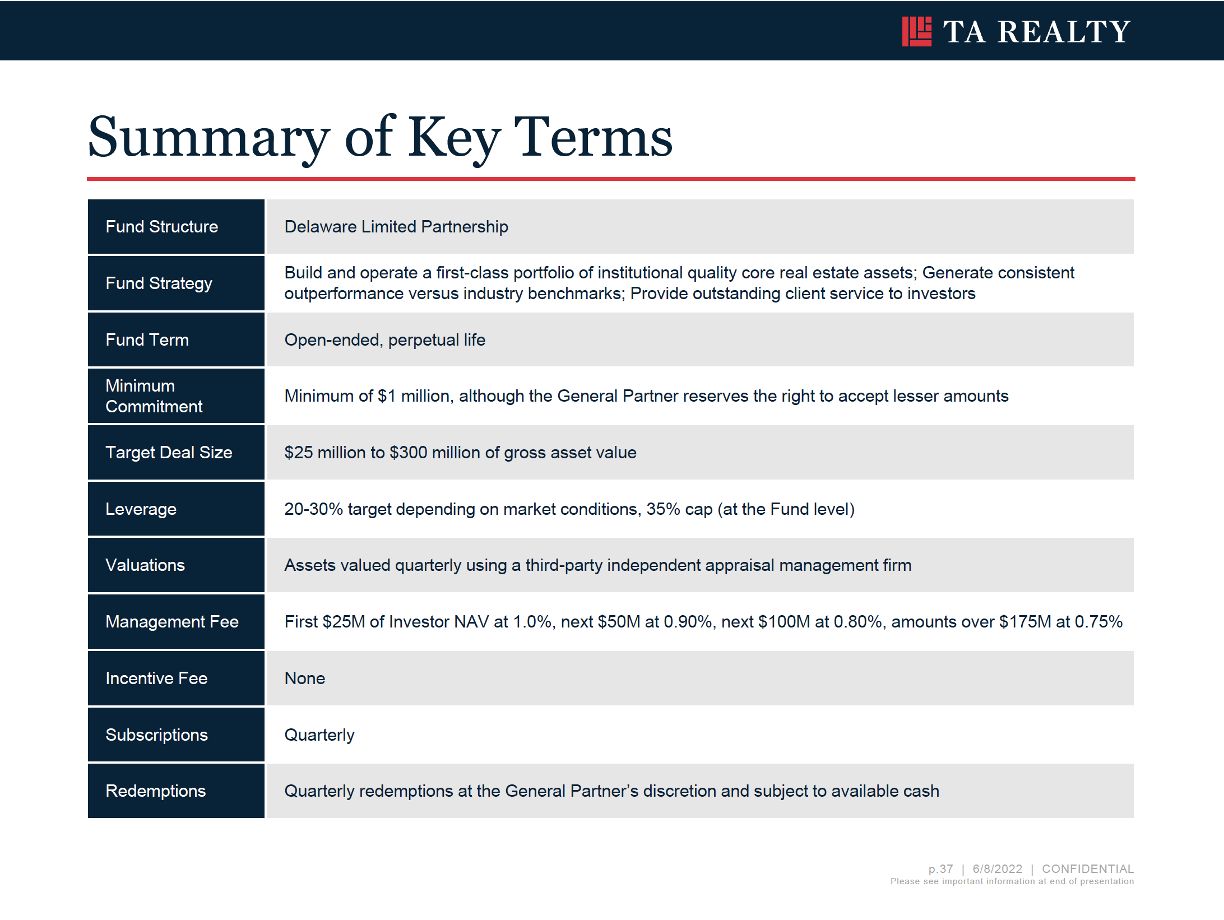

TA Realty Core Property Fund

Strategy:

Open-end diversified core equity

Life:

Perpetual, quarterly redemptions at the sponsor’s discretion and subject to available cash

Targeted investor returns:

TBD [CRE Analyst estimate: 8%]

Management fees:

First $25M of Investor NAV at 1.0%, next $50M at 0.90%, next $100M at 0.80%, amounts over $175M at 0.75%

Profit sharing:

None

---- Non-core, diversified ----

Fund:

AEW Partners Real Estate Fund IX

Strategy:

$750M value-add/opportunistic fund targeting tactical opportunities across multiple property types and regions

Life:

8 years

Targeted investor returns:

14% IRR

Management Fee:

125 bps on committed capital; 100 bps for LPs with capital commitments of $50 million and above.

Profit sharing:

First, all Partners receive a pro rata return of capital invested, plus a 9% cumulative annual return. Thereafter, cash available for distribution to LPs will be distributed (i) 50% to LPs and 50% to the GP until GP has received 20% of the cumulative LP cash distributions in excess of invested capital; then (ii) 80% to LPs and 20% to GP

---- Non-core, specialist ----

Fund:

Knightvest Capital Fund II

Strategy:

Value-add multifamily repositionings in growth markets.

Life:

7 years

Targeted investor returns:

TBD [CRE Analyst estimate: 14%]

Management fee:

1.5%

Profit sharing:

20% over a 9% preferred return, subject to a 50/50 GP catch-up, plus partial promote sharing.

COMMENTS