Narrative vs. reality: Dry powder

Narrative: "Private Equity Funds, Flush With $300 Billion, Stand Ready To Pounce as Recession Fears Fade" (CoStar, Dec 2023)

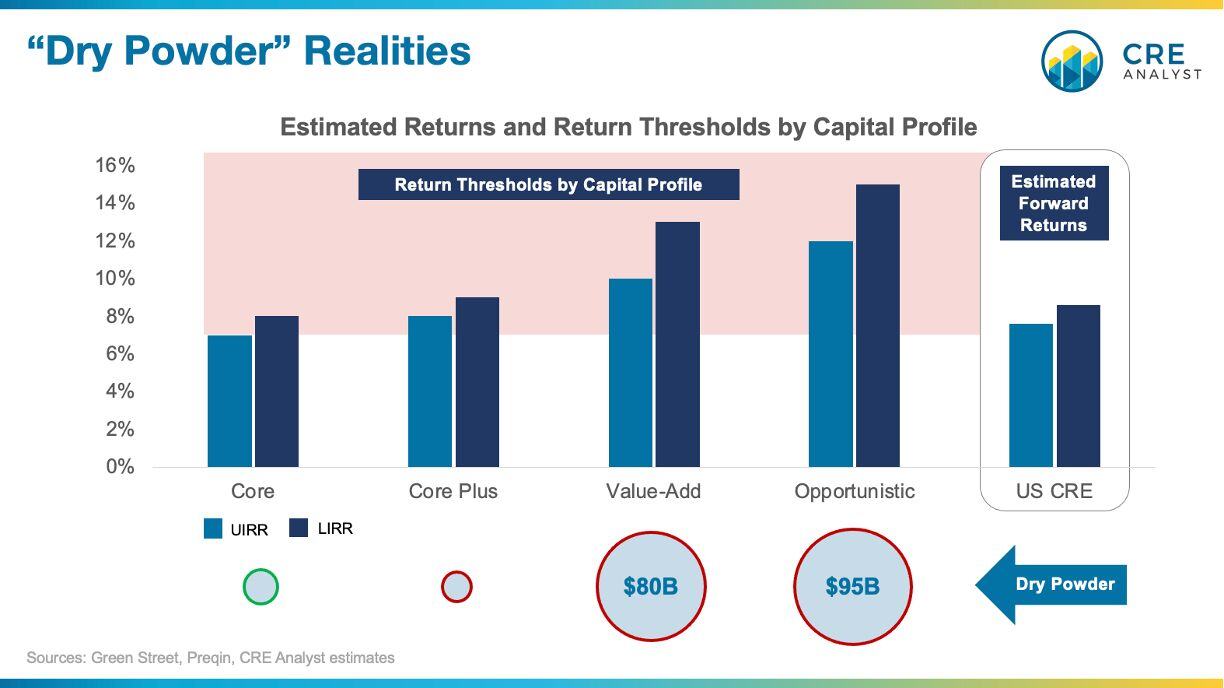

Reality: All of that dry powder was raised with big return expectations. Most of it needs returns 20%+ above what is currently achievable.

There are only four potential paths to more balanced capital markets...

Category A: More cash for owners

1. Operating cash flow growth

2. Higher reversion values (lower exit cap rates)

3. Reduced borrowing coupons

Or Category B:

4. Further price declines

Commercial real estate markets will unquestionably find a new balance at some point in the future. But via what path?

COMMENTS