DOUBLE PROMOTES are to LIMITED PARTNERS as:

a) IRS auditors are to creative accountants

b) Traffic jams are to commuters

c) Tanning beds are to dermatologists

d) All of the above

e) Something even worse than all of the above

---- What is a "double promote"? ----

Hypothetical scenario...

OPERATOR: Knightvest ("Operator") buys apartments, fixes them up, increases rents, then sells to a more income-oriented investors. The firm has roundtripped more than $3B+ with high 20% IRRs. Let's assume they target 20% IRRs for LPs going forward. Knightvest invests 10% of the capital needed to execute its strategy. Where does it get the remaining 90%?

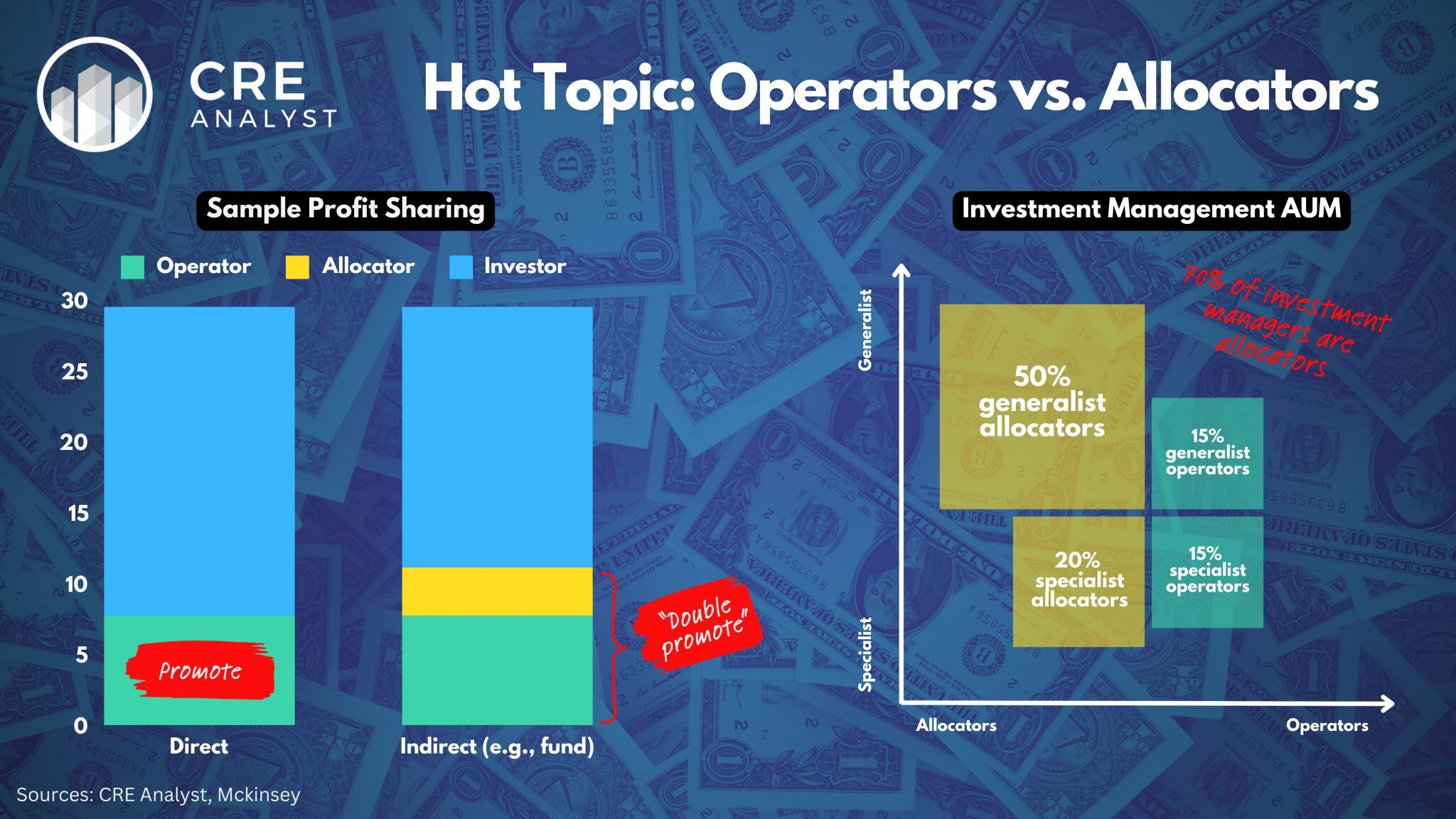

INVESTOR: Assume Ontario Teachers comes in with the remaining 90% for a deal ("LP") and accepts the following JV structure with Knightvest. 9% pref, 30% promote up to 15% IRR, then 45%. Knightvest gets a 35% IRR and Ontario gets 17%. On a $20M deal (equity) with $30M of profit, Knightvest's promote would be about $8M, leaving $22M for Ontario teachers.

ALLOCATOR: But let's assume Ontario wasn't directly invested in Knightvest's deal and was instead in a diversified fund, which then invested in Knightvest's deal. For simplicity's sake, let's assume that diversified vehicle was BREIT ("Allocator"). With BREIT's stated economics (1.25% annual fee with a 12.5% promote over 5%), Ontario would shift $3M of profit to the BREIT and would be left with a 15% IRR. BREIT would get about a 90% IRR. Knightvest's economics would stay the same.

---- What am I missing? ----

If you're a pension fund, why invest in the fund? Why would you take a 15% when you can get a 17%? LPs and their consultants hate this math. Why give up 150 to 200 bps of return?

---- On the other hand ----

1. Double promotes only come when returns are high. Real estate fund structures aren't like hedge funds. They're almost always over a preferred return.

2. Fund managers dp something with their time, and that time can be hard to replicate, especially for small LP staffs.

3. Lack of diversity. With a relatively small investment, LPs get immediate diversity by investing in most funds. But direct deals are lumpy. A bad deal or two can undermine performance.

Would you be surprised to see LPs focus on "direct investments" and pay for it with a few bad deals?

---- Takeaways ----

It's important to be able to 'follow the dollars' through partnership and fund structures. LPs and their consultants are increasingly focused on cutting out double promotes, but per McKinsey, only 30% of investment managers are operators.

What approach would you adopt if you managed a big pension fund?

A. You get what you pay for.

B. Cut out the middle man.

Ps -- are mid-sized allocators an endangered species?

COMMENTS