Is UBS quietly turning around the Trumbull Property Fund?

Core property funds account for a relatively small share of real estate equity markets. $300B or so of $3-4T. But they're extremely meaningful because they have the lowest cost of capital. i.e., they can pay the most for properties that satisfy allocation and risk targets.

UBS's Trumbull Property Fund (TPF) was the original core property fund (founded in 1978) and one of the largest such funds but has experienced significant pressure in recent years.

Quick sidenote: Core funds are open-ended/perpetual, and investors exit these funds by requesting to be redeemed by their fund managers (or they could sell their interests on secondary markets at a discount). Queues create real problems for managers, especially since exits are benchmarked to appraisals which tend to lag the actual market, incentivizing investors to rush for the exits.

----- Redemption queues -----

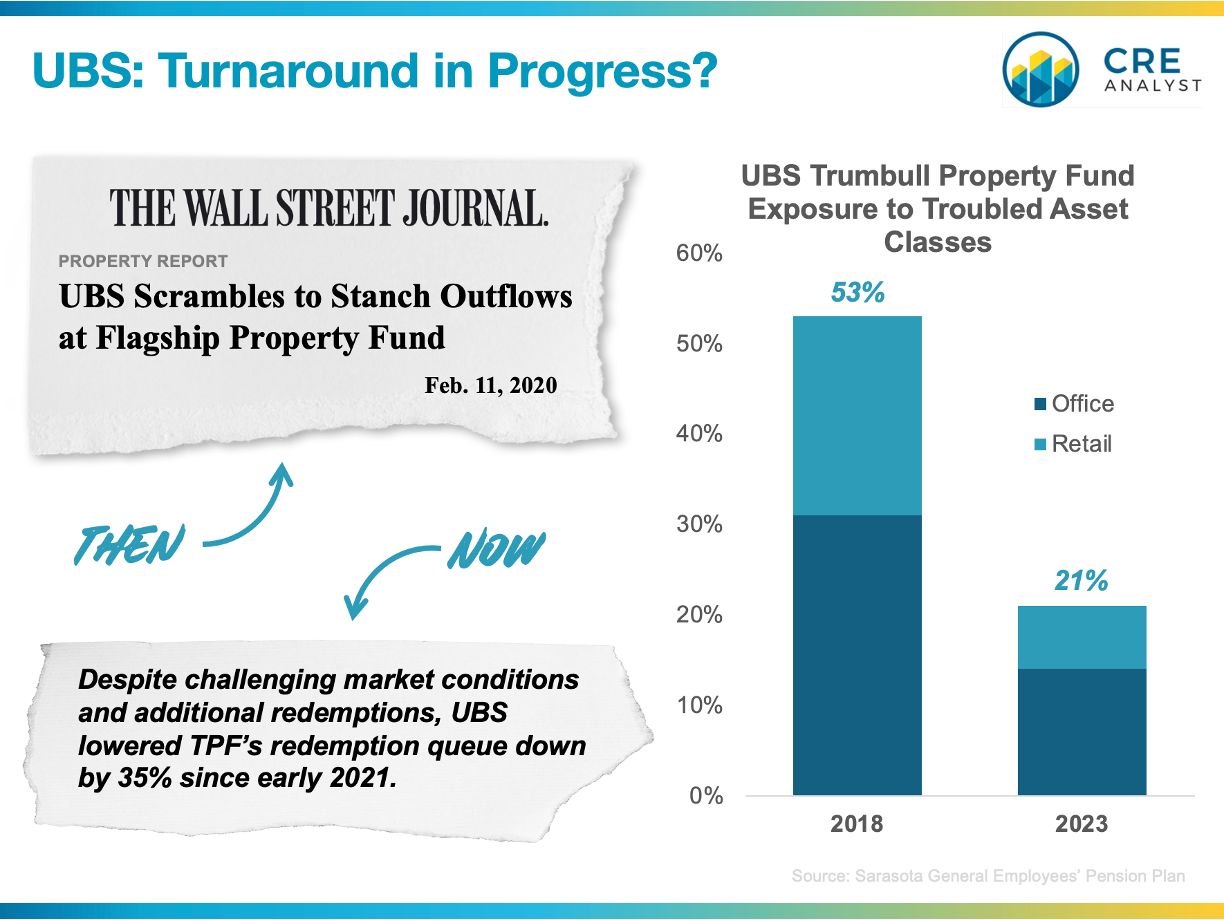

TPF has attracted a lot of attention in recent years as its exit queue ballooned to 40-50% of the fund's value. However, the fund's recent shifts have drawn a lot less attention...

According to TPF presentations to pension funds that were made public by pension fund clients, UBS has made significant progress on its redemption queue, redeeming $3.5B since 2021.

----- Repositioning the TPF portfolio -----

Perhaps more importantly, UBS has significantly shifted TPF's original problem: Overallocation to office and retail/malls.

Five years ago, more than half of UBS TPF was invested in office and retail properties, with some very large concentrations in older office buildings and malls.

But as of May 2023, office and retail made up only 21% of TPF, and industrial and multifamily accounted for 74% of the portfolio.

----- Conclusions -----

Redemptions with unlisted real estate funds get a disproportionate amount of attention, which is understandable; investors not being able to immediately get their money back sounds salacious.

However, we think the real story is in UBS's repositioning of TPF. It's a very important milestone for UBS and for the broader real estate industry. Why? Because values won't recover until perpetual investors (core funds, listed REITs, unlisted REITs) get comfortable enough to start investing again.

This could be the first step in a recovery, which could be accelerated with a major investment like UC's recent investment in BREIT, Buffet's 2008 investment in Goldman Sachs, etc.

COMMENTS