48% markdown?

One line buried in this tax return (p3) may explain why Fifth Wall is laying off staff.

David Sacks, Marc Andreessen, Sam Altman, Jensen Huang, Dario Amodei, Travis Kalanick, Peter Thiel, Naval Ravikant

How many of these guys had you heard of ten years ago?

Real estate’s version of a tech bro?

Many people would nominate Brendan Wallace.

Wallace launched Fifth Wall, one of CRE's largest prop tech investment platforms, about ten years ago with the backing of some of the biggest names in real estate.

Early funds did well, but then they doubled down. The early reads of that strategy are starting to come in, and they're not good.

How bad is it?

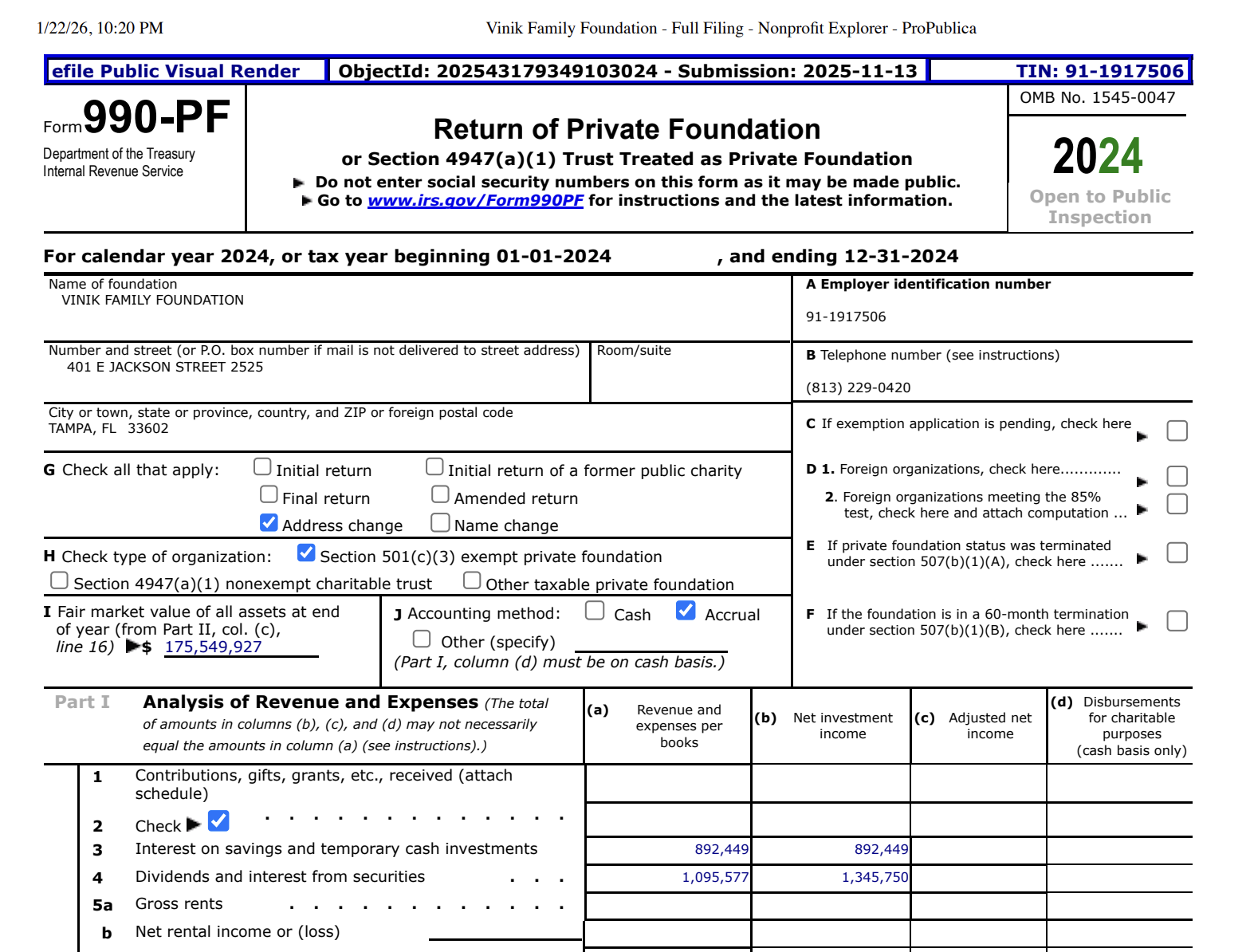

Only Fifth Wall fund investors know for sure, but we might have found an indicator buried in a family foundation's tax returns. This foundation is invested in a few Fifth Wall vehicles.

Fair market value vs. book value:

Fifth Wall Ventures II: +5%

Fifth Wall Ventures III: -48%

Fund II raised roughly $500M in 2018 and appears to have held up reasonably well. Fund III, raised in 2022 at over $800M, is a different story (at least based on this single mark).

Fund III LPs?

Hard to know for sure, but we found traces back to CBRE, Arbor, Cushman, Equity Residential, Pulte, Hines, Koch, and Invitation Homes.

Your takeaway from this situation...

(a) Nothing, it's just noise.

(b) Fifth Wall is toast.

(c) Too early to tell.

...depends on your perspective:

If you believe a second-hand datapoint can't say much about a fund, then (a).

If you believe prop tech funds are Adam Neumann-like mirages, then (b).

If you believe Fifth Wall still has dry powder (could be around 50%) with some time to deploy and recoup, then (c).

Our takeaway:

It's easy to spotlight problems at a high profile, formerly high-flying shop. Some people and media outlets will take the bait.

But Fifth Wall has been behind some of the largest advancements in real estate, and it only takes one or two big exits to make up for 50 bad deals.

A year or so ago Brendan Wallace estimated that the real estate industry was only in the 2nd or 3rd inning of tech adoption:

"Despite the influx of capital into the space and real estate's general embracing of technology, the vast majority of processes and business operations at large real estate companies remain old and antiquated."

Sounds like a reasonable take, but it's becoming increasingly clear that very few platforms will make it through this cycle unscathed.

More to come...

COMMENTS