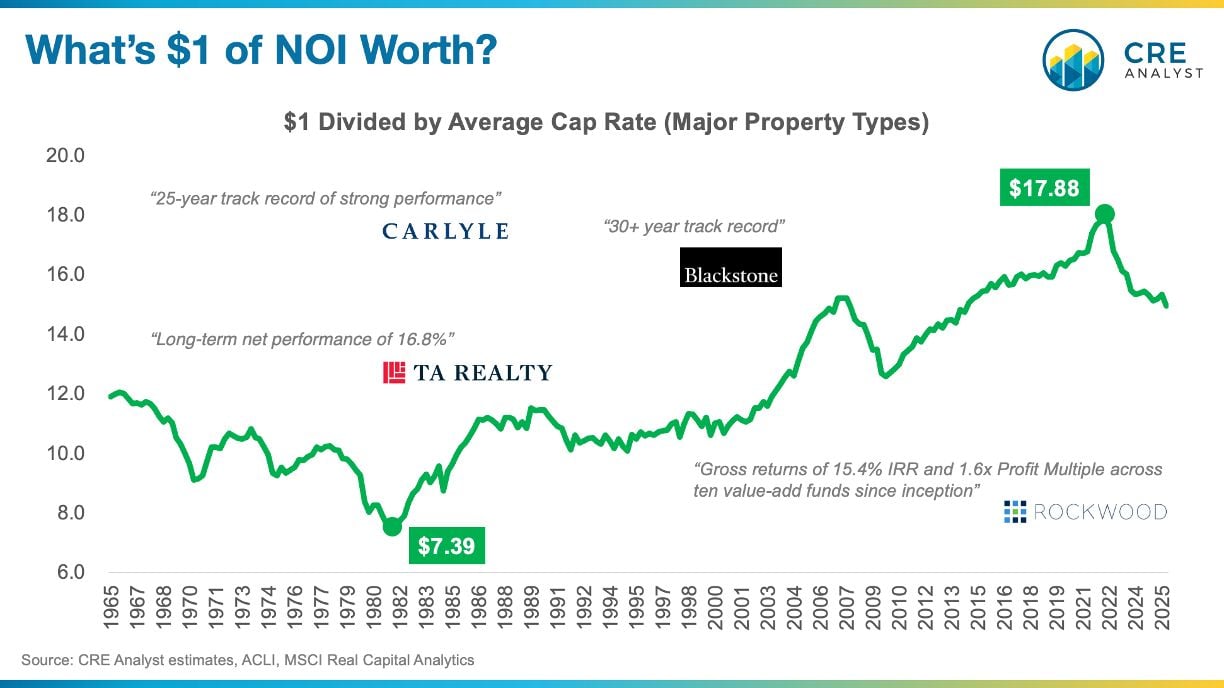

Cost to purchase a property in 1981? $7 for every dollar of NOI

That same dollar of NOI in in 2022? Worth $18

$1 of NOI in 1981 = $7 of value

$1 of NOI in 2022 = $18 of value

Nominal growth = 157%

Annualized growth: 2.3%

That's a 2-3% tailwind EVERY YEAR just for being in the game.

No inflationary growth or value creation.

With 6-7% income yields (average NCREIF income returns), that's 8-10% consistent annual returns for the safest perceived properties.

...all due to in-place income and structural capital tailwinds.

All you had to do was to be in the game for a decent period of time during those 41 years.

But those structural tailwinds are gone.

So how should we think about track records touted by managers to their investors?

COMMENTS