Clickbait vs. real risks: These CRE stories dominated headlines but turned out to be duds while real risks hid in plain sight…

6. WeWork:

Failed as expected. Didn't move the needle.

5. Retail apocalypse:

Before we were worried about office, we were worried about retail. The Amazon effect. Malls didn't move the needle and other retail is thriving.

4. BREIT implosion:

The reporter who broke the Enron scandal labeled BREIT a "house of cards" last year. ...for behaving exactly as advertised.

3. Negative leverage:

Like it or not, buyers still underwrite growth, and apartment cap rates remain sub 5%. How'd you miss this? By misunderstanding return measures.

2. Maturity wall

"Extend and pretend" sounds better than "scheduled extension.”

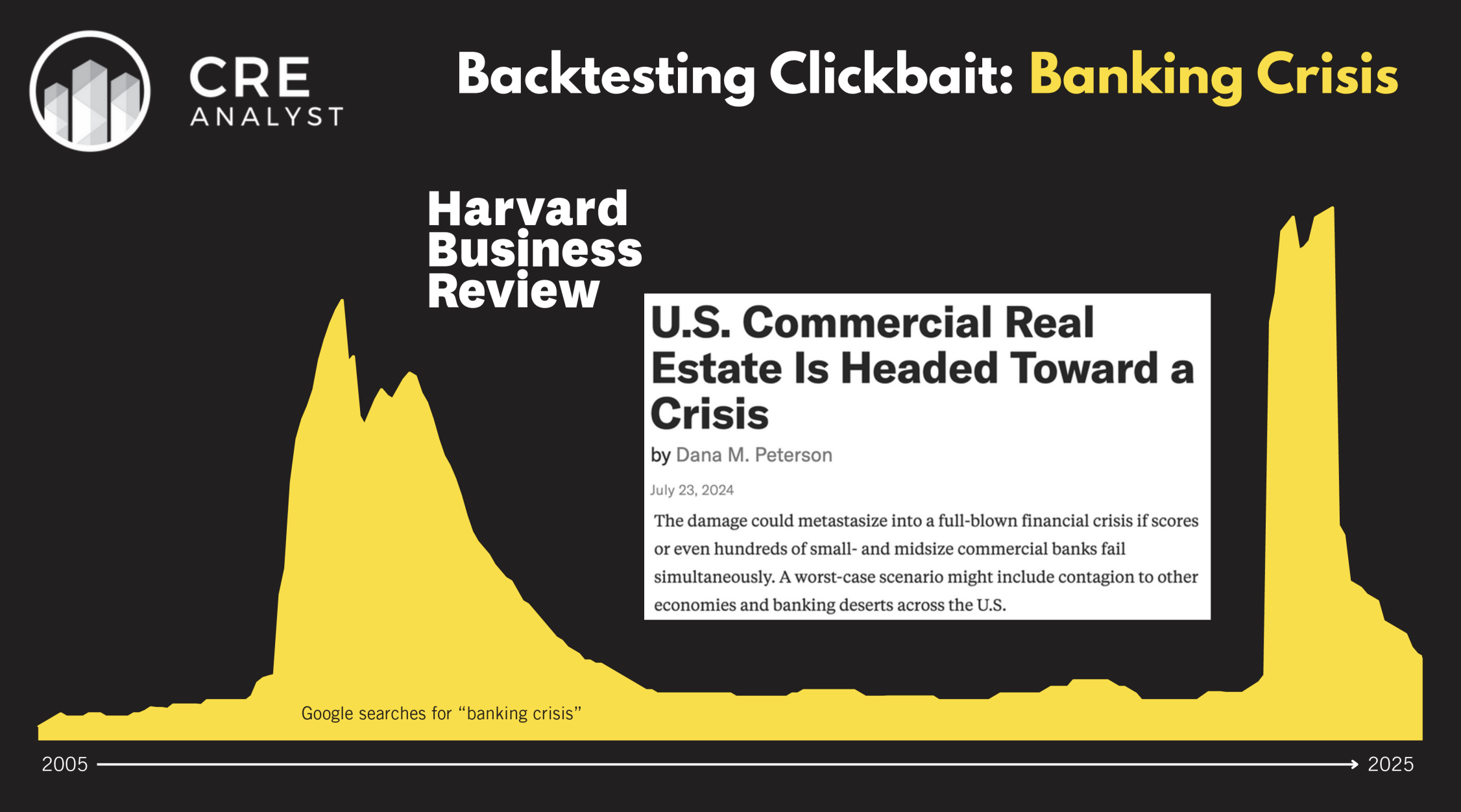

1. Banking crisis

Many media outlets were certain we were headed into a S&L crisis 2.0 after SVB's failure. Predictably, we didn't.

More worthy of the hype…

- "Doom loop" narratives: Some CBDs are entering a very dark, extended period).

- Syndicator implosions: Sparks are starting to fly.Office challenges: Tale of two worlds. Stress for the “have nots” is just beginning.

Conclusion…

The loudest risks weren’t always the most material.

Tomorrow: 5 real risks still flying under the radar.

PS — our approach to differentiating clickbait vs. real risks? The frameworks we cover in FastTrack. DM us to learn more.

COMMENTS