"Imitation is the sincerest form of flattery."

---- CBRE ----

Valuation:

~$50B

10-year change:

+220%

Why it works:

Bob Sulentic took over when CBRE was on life support. He stabilized it, slimmed it down, and turned it into a marathon runner.

The playbook:

-- Less debt

-- Less brokerage

-- More property/facilities management

Results:

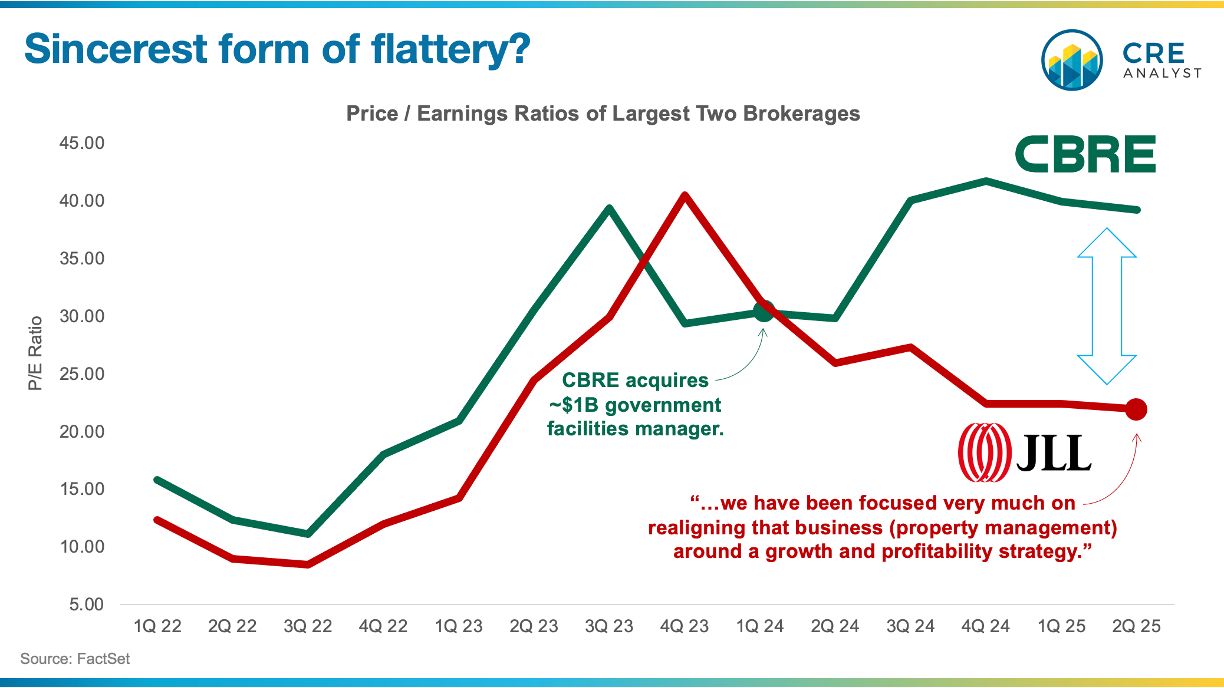

-- $1 of earnings was worth $19 five years ago

-- Today, that $1 is worth $40

-- Volatile brokerage → diversified services with sticky income

---- JLL ----

Valuation:

~$15B

10-year change:

+70%

Why it’s shifting:

More international exposure, more tech bets, but a bloated, high-churn management book. Last year, JLL started consolidating management lines, cutting costs, and trimming operationally heavy clients.

Results:

-- $1 of earnings was worth $14 five years ago

-- Today, $1 of earnings is worth $24

-- Multiple still trails CBRE, but recent moves are aimed at closing the gap

---- Takeaways ----

1. Property/facilities management may be the sexiest CRE businesses today.

2. Big real estate services firms are laser-focused on shareholder value.

3. Earnings matter, but multiple expansion delivers the biggest upside.

4. Would you rather have higher NOI, a lower cap rate… or both?

5. Today’s big broker playbook is very different from 10 years ago.

6. Even bigger differences vs. smaller rivals.

7. Those differences shape how these firms operate on the ground.

COMMENTS