Can REITs tell us how far property values may fall?

LEADING INDICATORS

REIT investors try to price in every change to market rents, occupancies, interest rates, etc. Consequently, public markets give us a preview of market waves that haven't yet been factored into private asset transactions. Given the market’s decent transparency around REIT property holdings/capital structures, we can use daily share values to arrive at implied property values.

UNIQUE ACCESS TO CAPITAL

CRE capital markets are notoriously fickle, but REITs benefit from unique access to debt and equity via public markets. e.g., Simon Property Group floated bonds during the darkest days of the financial crisis at 10%.

IF A TREE FALLS IN THE WOODS

Every time there’s a meaningful change in market conditions, transactions halt. Why? Because sellers are inclined to see value from a “glass half full” perspective, and buyers with cash when cash is king are inclined to see value from a “glass half empty” perspective. The gulf between these perspectives kills transaction activity and throws a blanket over property values.

FLOOR ASSET PRICING

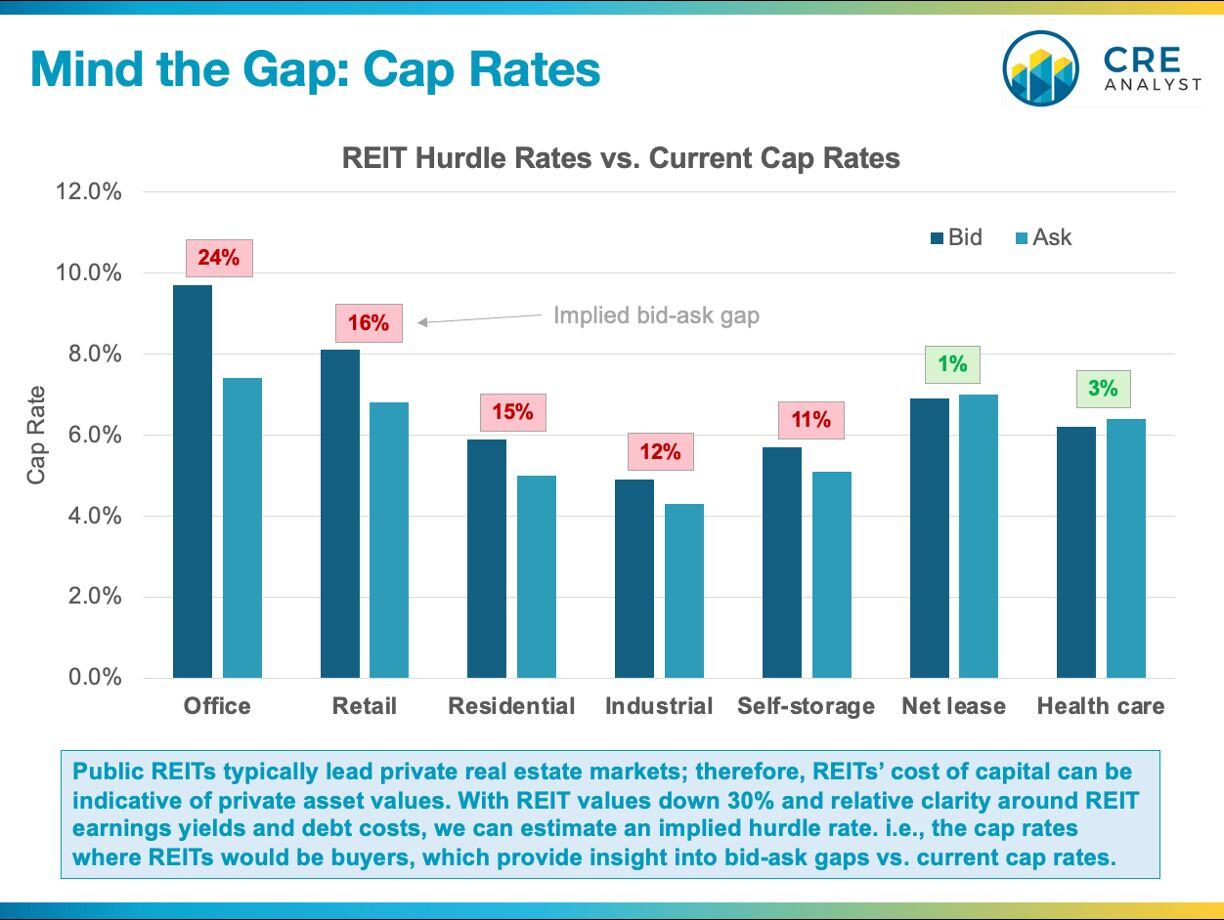

If (i) a REIT's NOI yield is 7%, (ii) its cost of debt is 5.5%, and (iii) it borrows 35% of asset values, then the REIT's blended cost of capital would be about 6.5%. Since managers are paid to create shareholder value and a substantial portion of their compensation typically comes from share price appreciation, managers would buy when cap rates are higher than 6.5% and sell below 6.5%. Knowing when REITs, the real estate players with the most consistent access to capital, would step in to start buying properties provides a theoretical floor for asset values.

IMPLIED PEAK-TO-TROUGH DEVALUATION

On balance, cap rates have been hovering around 6%, which generally isn't an accretive level for REITs to buy. But if they fell another 11% to 6.8%, REITs would likely be buyers. This 11% bid-ask gap varies substantially by sector. Assuming REITs set a pricing floor, here’s how far values would fall from recent peaks…

Office -55%

Residential -36%

Retail -31%

Storage -22%

Industrial -20%

Net lease -15%

Health care -9%

COMMENTS