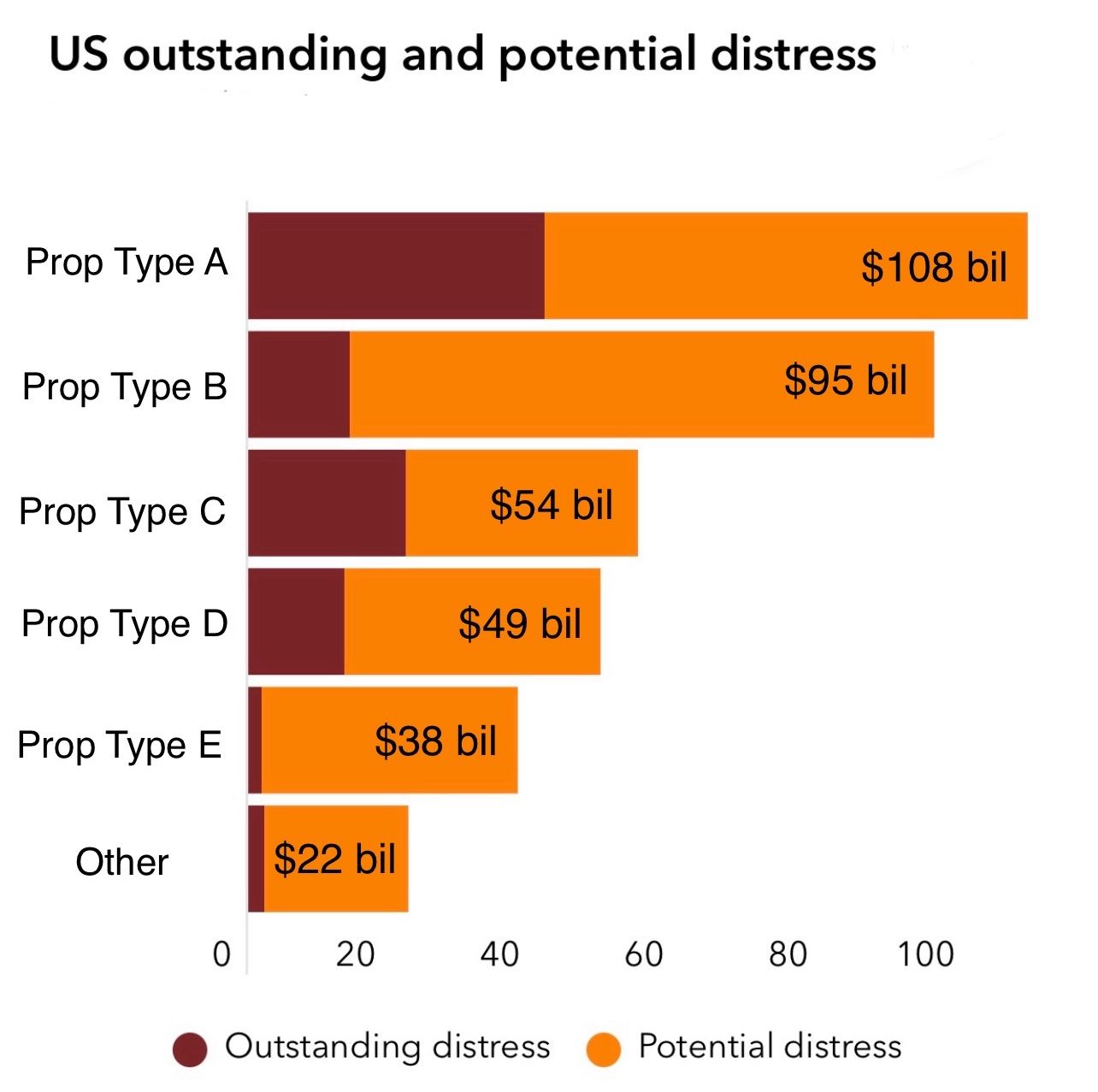

Office is the only “distressed” asset class, right?

We anonymized the labels on this chart. Maybe reality is more complicated than industry narratives.

How does this “distress” play out over the next 12-18 months? Does it go away in an orderly manner (perhaps thanks to “extend and pretend”) or does it explode as in prior cycles?

We anonymized the labels on this chart. Maybe reality is more complicated than industry narratives.

How does this “distress” play out over the next 12-18 months? Does it go away in an orderly manner (perhaps thanks to “extend and pretend”) or does it explode as in prior cycles?

COMMENTS