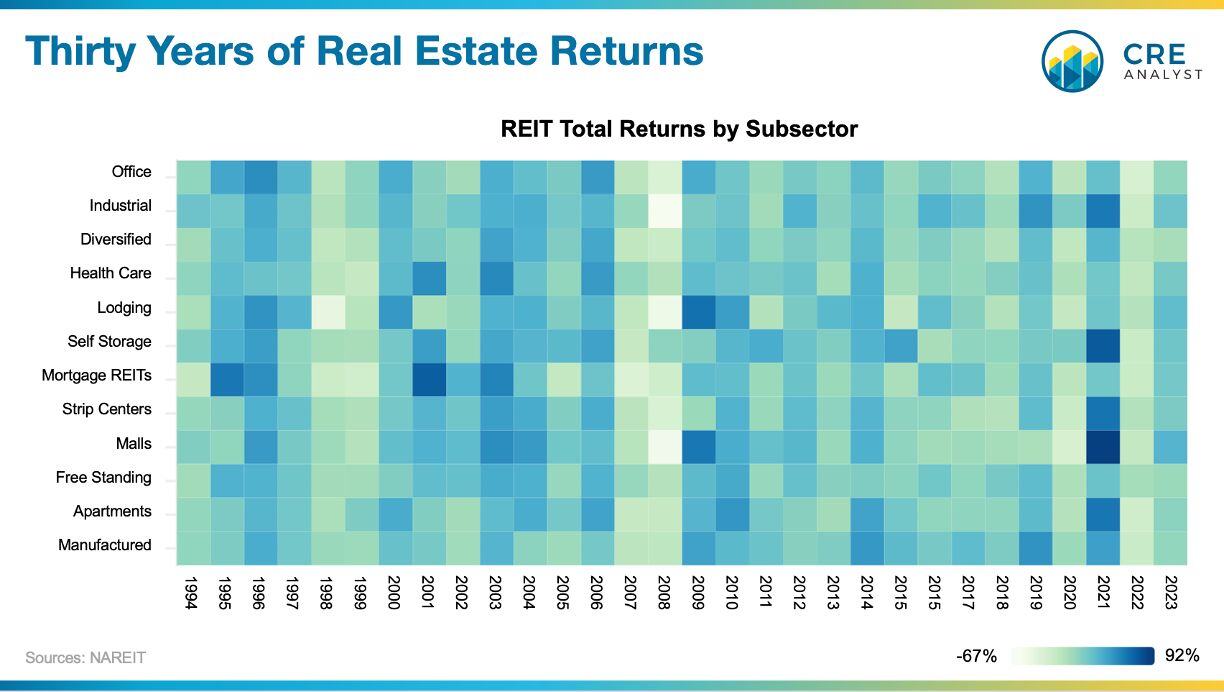

30 years of real estate returns...

-- Lots of green on this chart: A simple average across REIT subsectors over the last 30 years yields a 12% average total return. Have there been hard times? Yes. Once every ten years, on average, the sector backed up meaningfully. But it's also benefited by a strong tailwind.

-- Falling interest rates and cap rates: The 10 Year Treasury was about 2x the current 10Y 30 years ago and 10x+ higher than the post-Covid trough. Similarly, cap rates have fallen from 7-10% to 5-7%. Hard to overstate the value of this tailwind on real estate total returns.

-- Three big downturns: Total returns fell across the board following the Russian bond default in 1998 (-15%), Lehman's bankruptcy/GFC in 2008 (-36%), and the beginning of the Fed's rate hiking cycle in 2022 (-24%). Each downturn was followed by a strong recovery.

REIT's at a turning point: what's the most likely path forward?

-- Path A: Rising rates create a meaningful headwind, which will turn much of this green to yellow going forward.

-- Path B: REITs are poised to outperform since they generally have stronger properties and consistent access to relatively affordable debt and equity.

COMMENTS