2Q23 Earnings Recap: Big brokers fight for talent...

Our takeaways from 2Q 2023's brokerage earnings, which wrapped up yesterday...

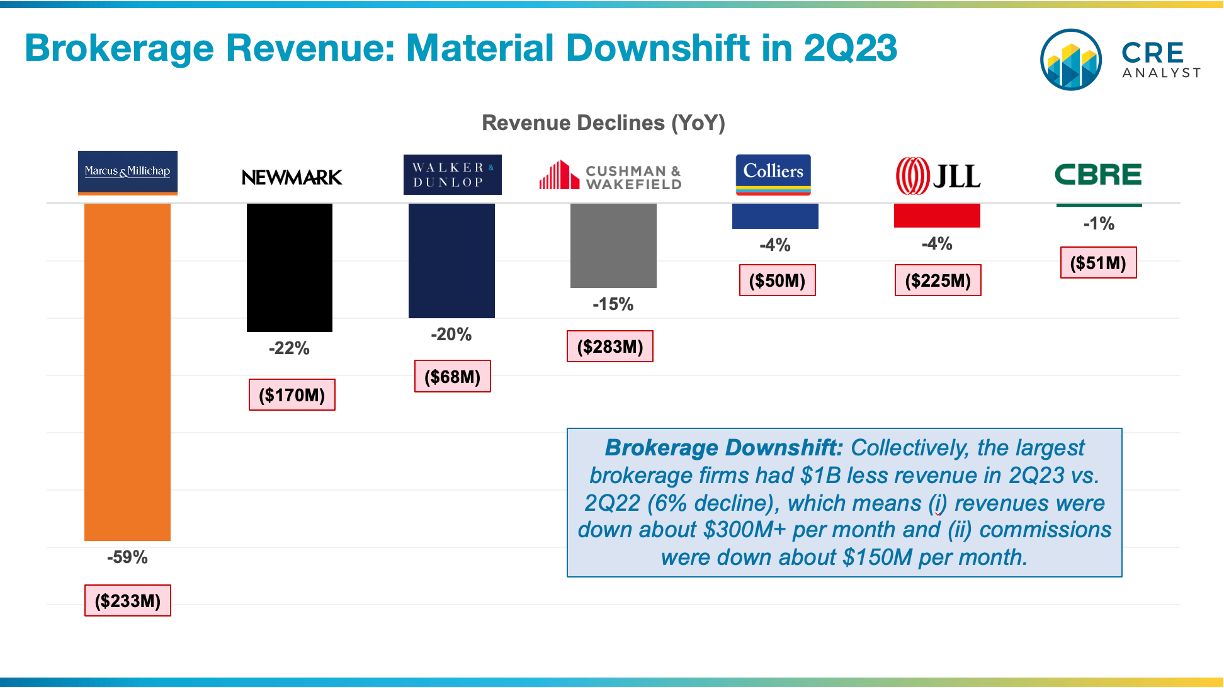

1. Declining revenue: Revenues across the large brokerages were down $1B vs. 2Q 22 or 6% YoY ($4B annualized).

2. Lots of variation: The largest firms were down 1-4% vs. smaller firms down 20%, but some of the big declines are compared to anomalous highs a year ago.

3. Battle for talent: Despite a slower environment and cost-cutting pressure at some firms (C&W, W&D), strong brokerage teams are in very high demand, and firms are gearing up to fight for them.

Earnings commentary around recruiting and retention...

Willy Walker (W&D's CEO): We continue to invest in our business even after our April reduction in force. The vast majority of our bankers and brokers are still with us.

Christian Ulbrich (JLL's CEO): Downturns often present great opportunities to invest in our business and we have been doing this over the last several months, adding brokerage teams in select markets that will position us to take advantage of the recovery when it transpires.

"It does seem like there's been a pickup of articles of people moving around. Can you just comment generally on the landscape and where the efforts may lie in terms of trying to recruit and retain folks right now?"

Bob Sulentic (CBRE's CEO): When we talk about recruiting and retention, it's heavily skewed toward our brokerage business. And our brokerage business is experiencing a good year and an active year on recruiting. We think it's going to measure up with some of the best years we've ever had. Even in a tough market, recruiting is expensive. ...recruiting the best brokers is like buying great companies; they never come cheap. But we're at a time now where people are finding their platforms and the companies they're in today being less supportive of what they want to do with their careers, less supportive of how they want to support their clients than they think CBRE can be.

"What does broker retention look like, given the persistently challenging market conditions? Do you feel well-staffed for a faster-than-expected market recovery if that were to occur?"

Michelle MacKay (C&W's CEO): Look, I think that we are in a particularly educated seat when it comes to broker retention. And I know there's some headlines out there, mostly negative, that have taken a bit more traction than the actual facts. If we have an individual or group that's been working for us, we have 5-10 years of financial history on that individual or team, and we know if they're enterprise positive or negative. So, we have perfect information when we make a decision. We also have a bit of a mix shift happening in the organization over the last 5 years. People with certain skill sets become more or less valuable. We are very much focused on retaining those individuals that will be part of future growth of the organization.

COMMENTS