Office market observations: the bad (2 of 3)

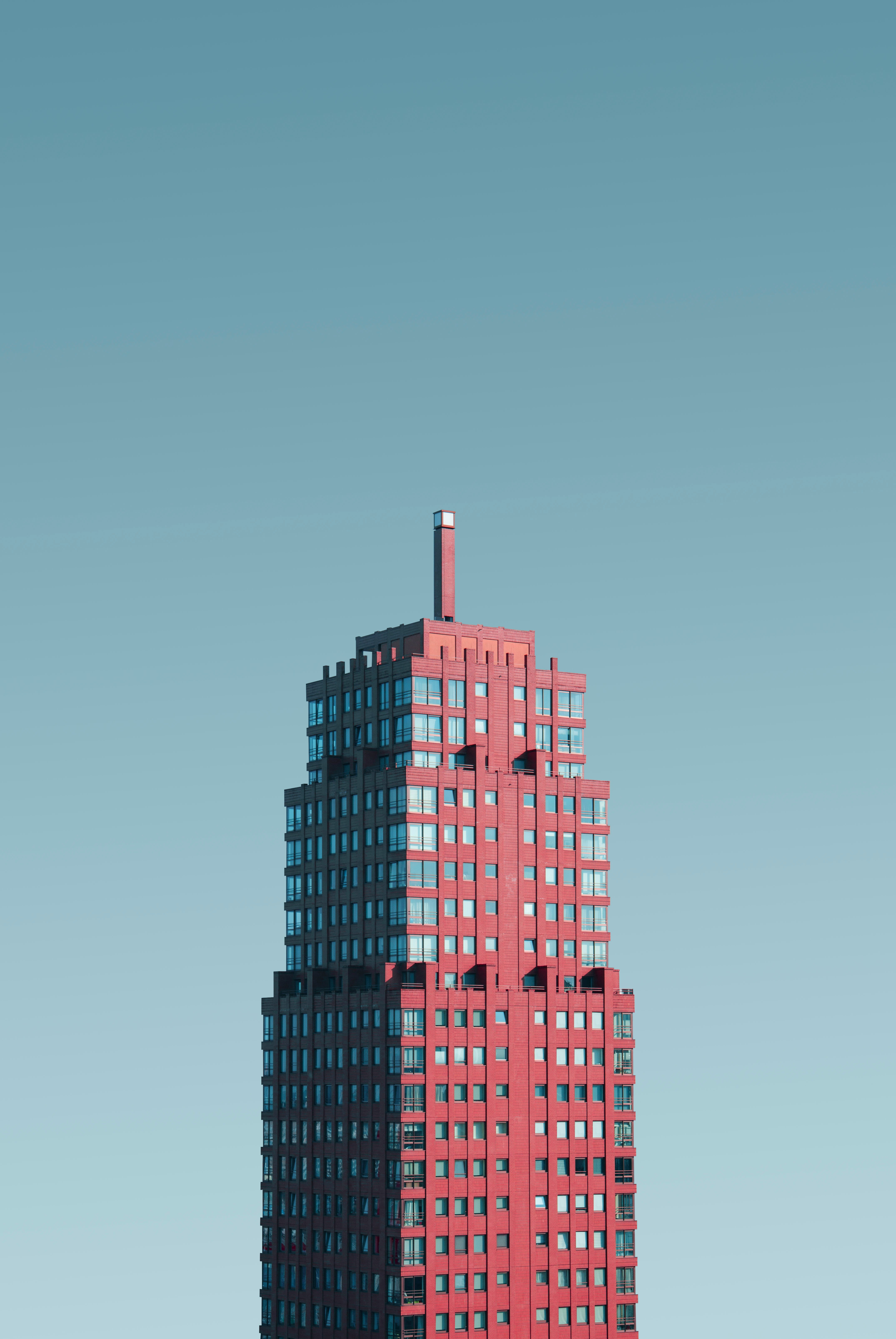

This is Trammell Crow Center.

Arguably the nicest building in Downtown Dallas.

The submarket’s availability rate is pushing 30%, but Trammell Crow Center has held up. It's nearly 90% leased.

That’s about to change: the building is set to lose roughly 25% of its rent roll when Goldman Sachs relocates to its new Dallas campus next year.

And it gets worse.

The current owner reportedly bought Trammell Crow Center for $615 million near the market peak, more than $500 per square foot, or twice what comparably-aged downtown buildings sold for.

Why the premium?

JP Morgan had spent over $100 million upgrading the asset. A new ground floor and lobby, new parking garage, and added retailers and amenities.

Then they sold it.

According to county records, the acquisition was financed with a $400 million loan from Wells Fargo.

The exact loan terms aren't public, but assuming the building sold at a 5.5% cap rate leads to an 8.5% debt yield at closing.

That loan likely matures soon (typical 3–5 year term), and its almost certainly floating rate.

Silver lining:

Even if the building loses Goldman (and others), it could probably still cover a 5–6% interest rate.

Will Wells Fargo or the owner be happy with an "extend and pretend" strategy? Definitely not.

But will they extend rather than foreclose? Almost certainly.

Why? Because this is effectively a brand-new trophy building with no direct competition. It's well-located, high-quality, and doesn't have to cover the soaring costs of brand-new construction.

Our bet is that Wells Fargo won’t want to test the market to find a buyer for a $400 million downtown office tower in today's environment. They’ll prefer to ride the in-place income and give the building a chance to re-lease and recover.

This building may not be representative of all troubled office assets, but it’s not alone either.

Good news: There seems to be a clear path to avoid massive principal losses with investments like this.

Bad news: The recovery won't be sharp or sudden. Think long slog.

COMMENTS