Apollo + Bridge = Four reasons you shouldn't start a real estate fund

---- Headline ----

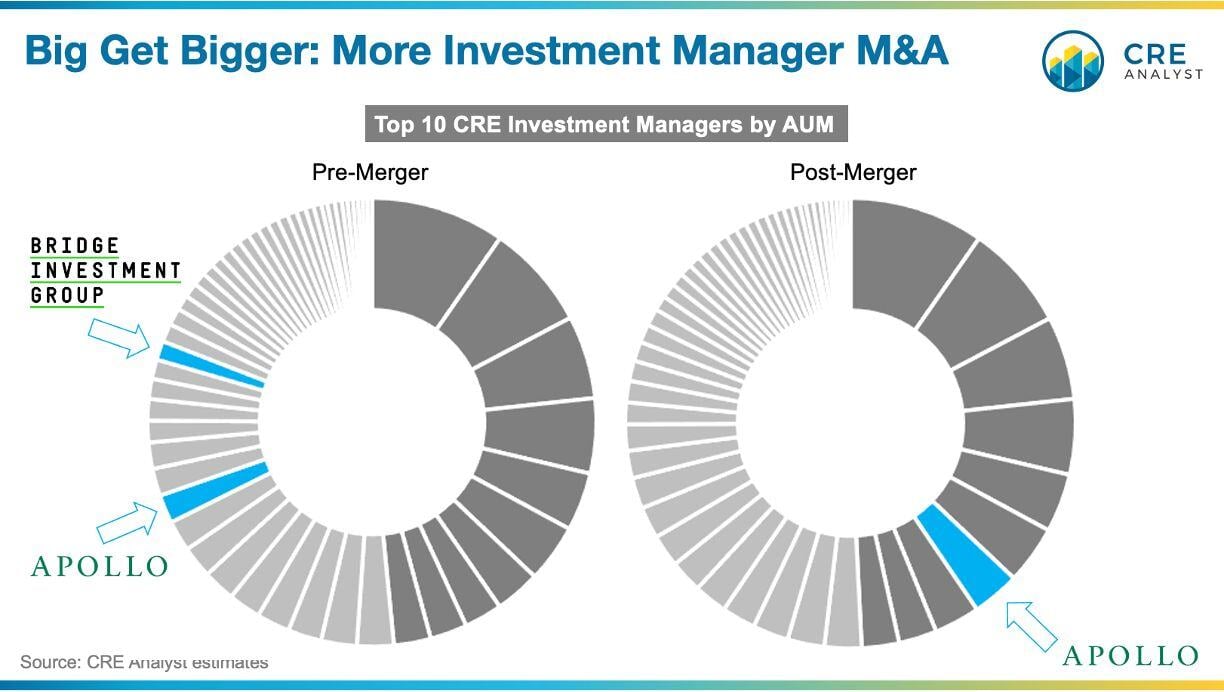

Apollo Global Management announced yesterday that it is acquiring Bridge Investment Group in a $1.5 billion all-stock deal. With this deal, Apollo’s real estate AUM jumps past $110 billion, pushing it into the top 10 of real estate investment managers.

This is part of a broader trend: scale wins. Deep-pocketed players with vast fundraising machines are swallowing niche specialists, extending their reach across asset classes.

---- Context ----

This is the second big investment manager merger in a week. Barings announced last week that it has reached an agreement to acquire Artemis.

---- Takeaways ----

The big real estate investment managers keep getting bigger, and there are fewer scraps for others.

Why?

1. Fundraising:

The large fundraising machines cannot be matched. If you were a $10 billion pension fund, where would you send a $25 million real estate investment: Apollo or Joe's bootstrapped industrial fund?

2. Talent:

Blackstone reportedly received 62,000 applicants for 200 positions in 2023. That's less than a 1% acceptance rate. Smaller platforms can compete, in theory, but talent matters, and top talent increasingly wants to be at large shops.

3. Data:

An inherent benefit of having $100 billion portfolios relates to observation. When you're sitting on hundreds of properties, you don't need to pay for third-party data. You see markets evolving as they move. You see windows open and close.

4. Scale:

In a world where the costs of admission--legal fees, startup costs, regulatory costs--are higher than ever, it's much easier for billion dollar platforms to front these costs. Smaller firms increasingly have to pick their spots, which inherently limits opportunities.

---- Questions ----

Where does this leave mid-sized managers?

Is there still room for independent platforms, or are we heading toward an era where only mega-firms dominate?

COMMENTS