WeWork and Twitter have a few things in common: Big personalities, endless press coverage, huge recent valuations ($47B for WeWork and $44B for Twitter), lots of liabilities, and clear paths to bankruptcy if the firms can't stop burning cash. There are also a handful of real estate lessons buried in these sagas.

Let's start with WeWork...

WeWork's path to a failed IPO was made into a highly-rated Hulu miniseries, appropriately titled WeCrashed, which seems appropriate given the larger-than-life nature of WeWork's key players. You've probably heard of Adam Neumann and Masa Son, but the most important player is less widely known (Sandeep Mathrani). WeWork's future depends on Mathrani, but let's quickly review how we got here.

Big personalities attracted a lot of attention and high valuations.

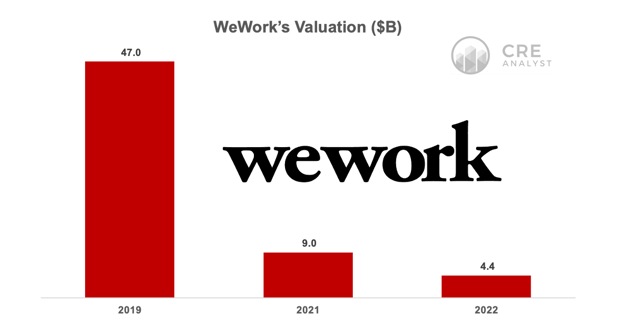

Masa Son ran SoftBank's Vision Fund and played a critical role in WeWork's meteoric rise. He invested heavily and was almost single-handedly responsible for driving up the company's value to $47 billion. [Real estate lesson 1: It only takes one buyer to make a market.]

WeWork's value is down by 90%.

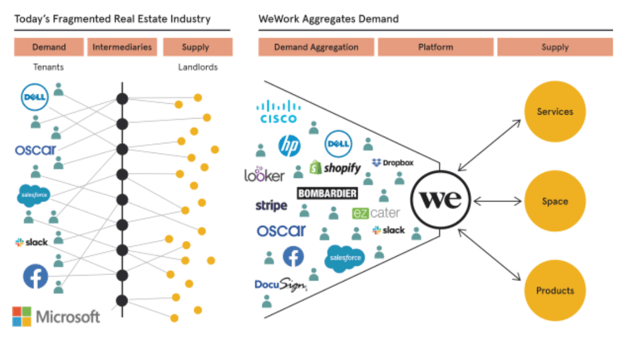

Adam Neumann is the smooth-talking CEO who founded WeWork, led its explosive growth, and straddled the company with lease obligations that it's struggling to live with. Neumann led the firm's first attempted IPO in August 2019, and his message was clear: "We are going to change the world by aggregating demand and delivering space as a service." WeWork's IPO filing summarized the firm's strategy in the following chart.

WeWork's original IPO pitch was comically generic.

WeWork's 300-page IPO filing was dense with jargon, tech-speak, and audacious statements. Sidenote: if you haven't read Scott Galloway's WeWTF on this topic, it's worth a read.

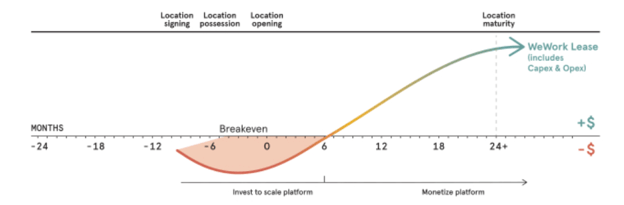

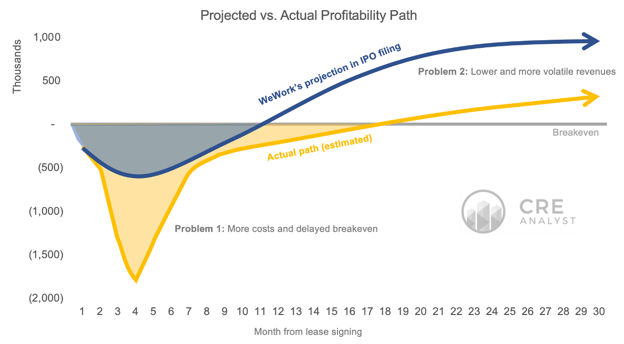

But of all the statements in WeWork's S-1, the diagram below was the single most important page in the filing. It summarizes how WeWork saw its path to profitability, conveniently not to scale, which basically says WeWork will have negative outlays in the first 12-18 months of a location's life. Breakeven occurs around month six, then stabilization occurs around month 24. Notably, the outlays would be dwarfed by returns after stabilization.

Who knows if the graph was accidentally bold or intentionally vague, but one thing we know with the benefit of hindsight is that Mr. Neumann bombed this projection. With hundreds of WeWork leases in the public domain, we can pretty easily estimate actual profitability, especially since WeWork is now public and releases earnings every quarter. The updated graph below is a lot closer to being accurate than Neumann's original diagram.

Two huge problems have defined WeWork's elusive path to sustainability, and both are easy to see in the comparison above.

1. Obligations and cost structure: Neumann drastically underestimated how long it would take to get operations up and running and how much it would cost, which is why you see a lot more yellow in the chart above (updated cost projections) than blue (original cost projections). Additionally, WeWork wouldn't have a source of revenue without having leased space to offer its members, and those leases are expensive, fixed, and long-term. In other words, this cost structure won't change unless WeWork can find a way to get out of its leases. Landlords won't let WeWork walk away without big payments, but they can be forced to adjust their agreements with WeWork if leases are rejected during bankruptcy.

2. Unpredictable revenues: WeWork's members can cancel their memberships with very short notice, which creates significant uncertainty around WeWork's ability to drive revenue. Leasing up empty space, regardless of how much free Kambucha is on tap, has proved to be much harder than anticipated. There are also a lot more people working from home now, which makes attracting office users difficult, competitive, and expensive.

[Real estate lesson 2: Be extremely careful with mismatched assets and liabilities. The financial graveyard is full of companies that mismatched assets and liabilities to generate more short-term liquidity and/or profits at the expense of sustainability.]

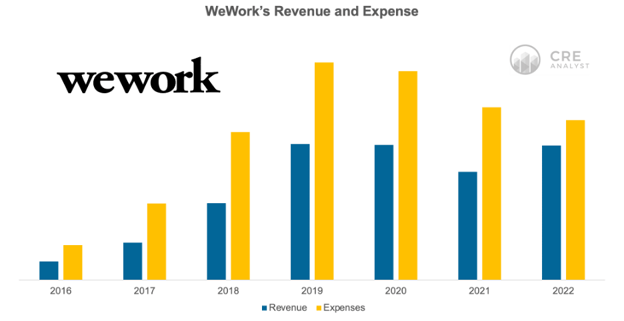

This combination of having a long-term cost structure with a short-term revenue structure is at the heart of WeWork's fundamental challenge and largely explains why expenses have dwarfed revenues to date.

WeWork has consistently operated at a loss.

An adult in the room: Sandeep Mathrani

You can see from the revenue and expense chart above that WeWork has never turned a profit. The combination of Neumann's extreme growth and Covid led to a very bloated cost structure leading into 2021. Sandeep Mathrani, known for turning around GGP after its bankruptcy in 2009, took over as WeWork's CEO in 2020.

"The problem with the business was the expense structure was upside down. I knew I could make this company profitable if I could get the SG&A structure right and rightsize the real estate portfolio." - Sandeep Mathrani, WeWork CEO

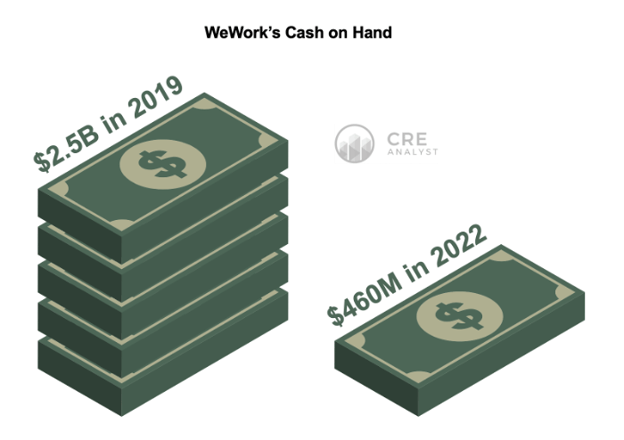

Mathrani has focused on stabilizing the firm's cost structure and has moved the firm toward profitability. WeWork's occupancy recently exceeded 70%, and the firm is operating with a positive margin at the property level. Nevertheless, Mathrani is in a race against time, as losses are quickly eroding WeWork's cash.

WeWork's cash is down by 80%.

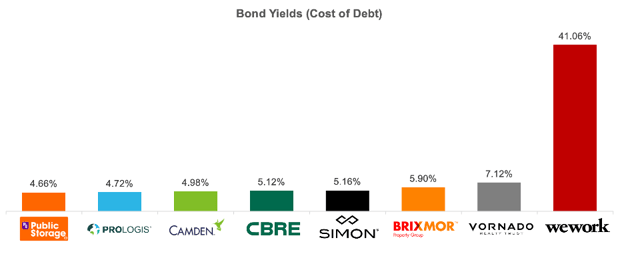

WeWork's dwindling cash position helps to explain why the firm's debt is trading at much higher implied rates than other real estate companies.

WeWork's implied cost of debt is 40%, which reflects a very high assumed probability of default.

[Real estate lesson 3: The cost of debt is extremely important. Once the cost of borrowing exceeds the unleveraged return on an asset, more debt pushes down leveraged returns and quickly creates significant liquidity issues.]

Now let's turn to Twitter...

Twitter seems to have tough times ahead.

Quick review of the Elon Twitter saga...

1. Elon Musk, the richest man in the world, started buying a lot of Twitter stock in January 2022, and within a few months, he secretly accumulated about 10% of the company. His basis was $30-40 per share.

2. In March 2022, Elon approached some Twitter executives about joining the board or buying the company. Otherwise, he insisted, he might start a competitor.

3. In early April, Elon agreed to join Twitter's board but he (almost) immediately changed his mind and instead submitted an offer to buy Twitter for $54.20 per share with no financing contingency and no diligence requirements. [Real estate lesson 4: Contracts matter. Real estate lesson 5: Don't waive diligence.]

4. All of this was happening in April 2022, which coincided with the overall market's violent downshift. Values, especially of technology companies, have generally been in a freefall since. Twitter increasingly loved Elon's offer since it was far above its market value.

5. In May, Elon looked for a reason to get out of the merger agreement. He started complaining about bots and fake users. Journalists spent thousands of hours documenting the potential validity and invalidity of Elon's complaints, but in the end, they didn't matter because Elon signed an enforceable contract.

6. After a few months of back and forth in the Delaware chancery courts, Elon realized his complaints were going nowhere and that the court would likely (as it had in previous cases) enforce the contract and force Elon to buy Twitter. Elon bought Twitter in October for $44 billion, using about $13 billion of debt. Based on other tech companies' declines and Twitter's bleeding revenue, the company might be worth about $10 billion now.

Elon has an unconventional approach to corporate communications.

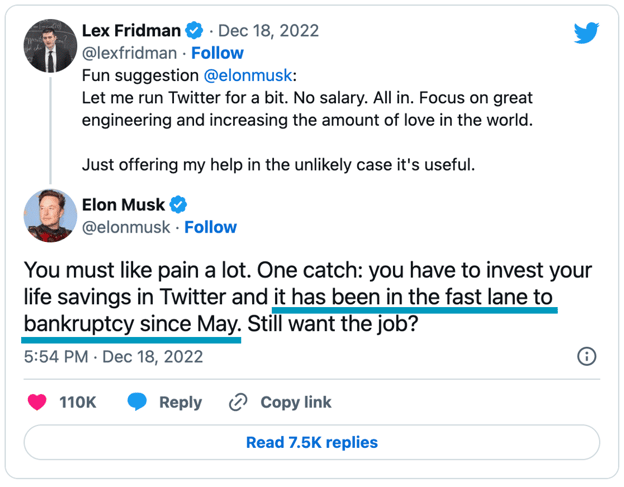

Elon recently said that Twitter "has been in the fast lane to bankruptcy since May," which shouldn't be all that surprising given Elon's first month as the company's CEO. The self-proclaimed "chief twit" has consistently insulted employees, advertisers, users, journalists, politicians, and security experts.

Bottom line: Elon overpaid for a company. Then the company's value fell due to market conditions. Then the value fell even more because it is bleeding advertisers. [Real estate lesson 6: You need to be good at valuing assets before you buy them.]

WeWork vs. Twitter

Both firms are an unlucky break away from bankruptcy, but they are both are ubiquitous platforms. Twitter has more than 200 million daily users (even if half of them are bots, 100 million users is very meaningful). WeWork has more than 760 locations and is more than 70% occupied with around 700,000 users.

Regardless of what happens to WeWork and Twitter, it's important to understand the root of their problems. Twitter is in trouble because it was capitalized at an extreme peak value. If history is indicative, it will be very difficult for Elon to outgrow Twitter's debt. WeWork is in trouble because it, like Twitter, is struggling to outrun obligations, but WeWork's primary obligations are long-term office leases. Importantly, there are only two solutions to these problems: 1) aggressively grow income or 2) find a way out of the existing liabilities.

WeWork seems to be doing a much better job of growing income, but it may be forced to rethink its lease obligations. Elon similarly may be rethinking the debt that investment banks provided to finance his Twitter transaction. As Elon knows from his recent experience in Delaware Chancery Court, the U.S. legal system takes contracts between willing parties very seriously. Therefore, bankruptcy filings may be a necessary step in rightsizing one or both of the firms.

COMMENTS