Think about how much volatility we've experienced in the last few years: A global pandemic killed more than a million people. We had a deep recession, then a roaring recovery. Unemployment approached 15% before falling below 4%. Home prices increased by 50%. Mortgage rates went from 3% to 7%. Our bank account savings grew from $800 billion to $5 trillion. ...all in less than 36 months.

This has to be the most uncertain economic period of the last hundred years. Who really knows what's going on under the surface or where we're headed? Forecasting future outcomes seems like a waste of time. ...unless the process of thinking about future events teaches us about key relationships and frameworks. With that goal in mind, here are our 10 predictions for 2023.

1. Property values fall by 10-20%

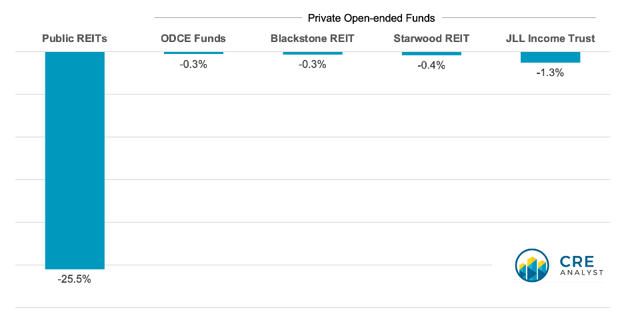

Real estate values get hit hard when interest rates go up, so it’s no surprise that property values are falling. Publicly traded REITs led the way in the second half of 2022 and have fallen by more than 25%, but private funds have been slow to recognize these declines.

REIT stocks are down 25%, but valuation declines haven't hit private funds, yet.

This has received a lot of attention in the press because it’s easy to turn Blackstone, Starwood Capital Group, and their peers into ogres who won’t let investors out of their funds. But with no daily trades, the only way to value those funds’ assets is via appraisals, which are inherently backward-looking. It is common for private values to follow public market action. However, the pace at which values have moved has created a much larger delta between private and public asset values than typically exists. Value declines have already come to the public markets, and they are currently working their way through the private markets.

2. $30B of “gated” equity piles up in private real estate funds

Open-ended real estate funds tend to focus on core, bond-like real estate. Investors are okay with parking their money in these funds when they expect steady income and decent appreciation over time, but when markets turn many investors get spooked and want out. Letting them out en masse pushes down values, which is bad for remaining investors. Therefore, fund managers reserve the right to “gate” equity departures. We think these gates will fly up in 2023, leading to a build-up of more than $30B of equity queues at Blackstone, Starwood Property Trust, JLL Income Property Trust, Ares Management Corporation, and National Council of Real Estate Investment Fiduciaries (NCREIF)'s ODCE funds. While the lack of liquidity is negative for the investors in the queue, this gating protects long-term investors by not forcing the sale of assets into a slow market.

3. 100K+ technology job losses

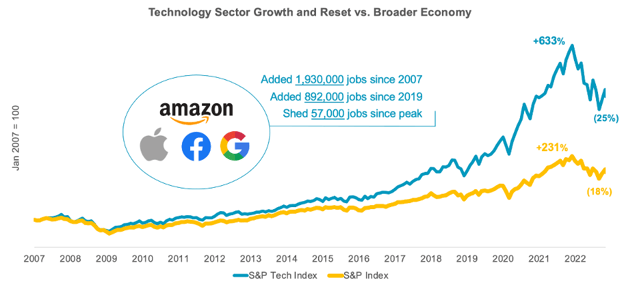

Tech stocks have outperformed the broader market by nearly 3x since the financial crisis.

Amazon, Meta, Apple, and Google added nearly 2 MILLION jobs over the last 15 years, and more than 40% of the jobs (about 900,000) were added in the last 36-48 months. These firms have only shed about 3% of their total headcount in the last few months. Regardless of one's opinion of Elon Musk, his ability to run Twitter with a reduced headcount is forcing firms to take a more critical look at their cost structure. There will be increasing investor pressure on these firms to reduce costs to grow income as their valuation multiples come down.

We estimate that about 60% of those jobs are relatively high-paying professional jobs, and they've been concentrated in a handful of key U.S. tech markets such as San Francisco, DC, and Austin.

Speaking of Austin... There are more than 100,000 tech employees in Austin in nearly 7 million square feet of office space. Two challenges: 1) this is a lot of space for Austin (downtown Austin has about 20 million square feet of office space), and 2) most of the growth has been recent and exponential (our guess is that 75% of the 100K+ tech workers in Austin are in jobs that didn't exist six years ago). Look out below.

4. More workers go back to the office

Office workers have more flexibility than ever, but the pendulum is moving back toward employers. The share of job openings labeled as “remote” has fallen by about 10% since early 2022. And according to Kastle Systems card swipe data, 40% of cards were being used a year ago, 50% are being used now, and we think it will reach 60% next year. New York and San Francisco will be the biggest beneficiaries, and we think we’ll see a lot of headlines about the resurgence of urban environments in 2023.

Sidenote: Card swipe data is an effective way to see how many people are in the office, but it wasn’t a widely published dataset pre-Covid, so we don’t really have a good baseline of what’s normal. Has any firm ever had every single person with an access card in the office at the same time? Doubtful. If the baseline is something like 75% instead of 100%, 60% card capacity would say that 80% of workers are back to the office.

More broadly, we don’t view WFH as a siloed issue. Covid simply added a category of what employers will need to consider to attract and retain talent. We think hybrid working is here to stay and will be negotiated a lot like PTO days, bonuses, etc. The long-term stickiness and prevalence of WFH will vary by industry and geography.

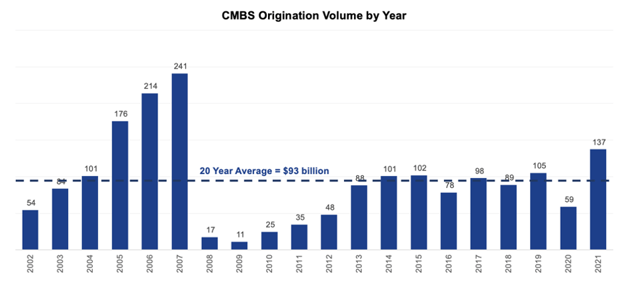

5. Lowest debt originations in a decade

There are five types of real estate lenders: Banks, insurance companies, CMBS, agencies, and debt funds. Banks, CMBS, and debt funds are on the sidelines and probably won’t open up much until at least mid-2023. Insurance companies and agencies are open, but they are selective, and there’s very little demand from borrowers for long-term fixed-rate debt at today’s rates. Debt markets will eventually thaw, but it’ll likely be slow until they do. We think we’ll have the slowest debt year in a decade with less than $50 billion of CMBS in 2023.

CMBS has found a natural level of about $100B of production a year (post-GFC). We see it down by 50% in 2023.

6. Blackstone buys a big REIT

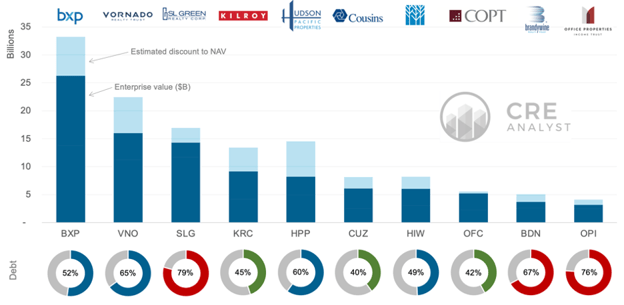

REITs are down across the board, but office REITs in particular are discounted: Down 30% this year—trading 20% to 60% below what their assets are worth in the private markets—with 8% implied cap rates.

Example: Cousins Properties had a lot of challenges 10-15 years ago, and was essentially an overleveraged development company, which wasn’t well received by shareholders across multiple cycles. But CUZ is a totally different company now with 40% debt-to-assets and minimal development exposure; they own coupon-clipping office buildings in growth markets, and their rents are 10% above pre-Covid levels. Cousins is trading about 35% below NAV.

REIT stocks are down big in 2022. We think Blackstone or Brookfield will buy an office REIT in 2023.

Since CEO disposition has a lot to do with a firm’s willingness to sell, guessing about specific companies is inherently random. [Note: We don't own any office REITs, don't give stock-picking advice, and picked CUZ randomly from the list above but could have easily profiled Boston Properties, Vornado Realty Trust, SL Green Realty Corp. Kilroy Realty Corporation, Hudson Pacific Properties, Highwoods Properties, Corporate Office Properties Trust, Brandywine Realty Trust, or Equity Office Properties Trust.]

It’s a lot easier to guess who the likely buyer will be. Blackstone has been involved with 1 of every 10 REIT M&As (all time), and they’re sitting on $60 billion of dry powder. Similarly, Brookfield Asset Management just raised a $17 billion fund and is already a big office owner. But we see Blackstone leading the charge in 2023.

7. Brokerages battle for talent and market share

Eight publicly owned brokerages employ 320,000 workers (mostly brokers) and are generally in much better financial shape compared to last time we saw a wave of consolidations. Higher interest rates will likely correspond to lower transaction volumes, which sets up a very different landscape going forward.

The fight for market share is on, and we think we’ll see fewer mergers and more team poaching, specialty acquisitions, and retention bonuses for junior brokers. It’s a lot cheaper and more certain for a firm sitting on excess cash to pay a proven brokerage team 1-2x their annual production than to pay 7x earnings for a company that comes with integration issues.

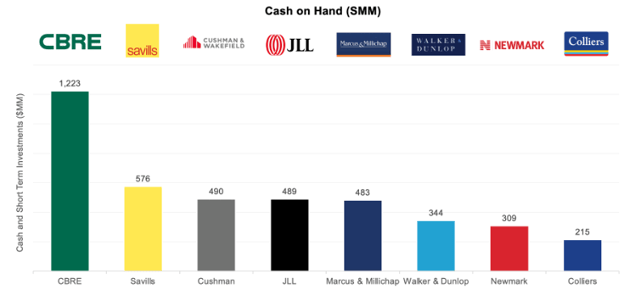

Big brokerages are sitting on a lot of cash and will need it to fight the coming battle for market share.

We think it’ll also be increasingly difficult for brokerages to retain their 25-35 year old top talent, as those junior brokers think about how their splits will fair in a slower volume world. We think firms in growth mode will increasingly pay retention bonuses as they push for market share.

CBRE, Savills, Cushman & Wakefield, JLL, Marcus & Millichap, Walker & Dunlop, Newmark, and Colliers are poised to step up the battle for talent and market share in 2023.

8. Exodus of real estate boomers

The CEO of CBRE, the largest real estate company in the world, is 65; the CEO of Vornado is 80; the CEO of Kilroy is 73. The average age of a REIT CEO is around 58. We pulled information from 50+ real estate companies and found a similar trend: Lots of 60+ leaders at the top. They’ve made a lot of money and appreciate, probably more than anyone, that big downturns aren’t fun.

We think there’s a good chance that 2023 will mark the beginning of the end for many of these leaders. Some will retire altogether, while others (especially at smaller firms) will move into advisory roles, hold some ownership, and invest in projects while they live between multiple homes and play with grandkids. If we’re right, there could be a lot more opportunity for upward mobility and a lot more risk as organizations attempt to navigate succession planning.

There is a strong opportunity for firms to gain (or lose) strategic advantages for years to come if they smoothly coordinate this likelihood with the reality of prediction #7 above.

9. Cracks in the multifamily armor

Investing in apartments has consistently generated 15%+ returns over the last several years, but several challenges could make continued outperformance unlikely. Rent growth has slowed from 10%+ to 3%, population growth and household formations are slowing meaningfully, nearly 1M units are under construction and will likely push the national vacancy rate over 10%, property taxes and insurance are increasing at above-inflationary levels, and cap rates are increasing. Unfortunately, markets with high-cost escalation also tend to have the largest construction pipelines. Oh, and if you’re one of the country’s largest managers, there’s a decent chance you’ll be involved in a class action lawsuit about your rent pricing software in 2023.

10. Co-working finally faces the music

WeWork and Regus are carrying $20+ billion of long-term leases and debt on their books. If the economy hits the skids, we think large coworking firms will reduce their lease obligations by either proactively working with landlords or via bankruptcy. Most notably, we think 2023 will be the year WeWork tries to rip up many of the leases it signed over the last decade. The firm is fighting for survival under the leadership of Sandeep Mathrani.

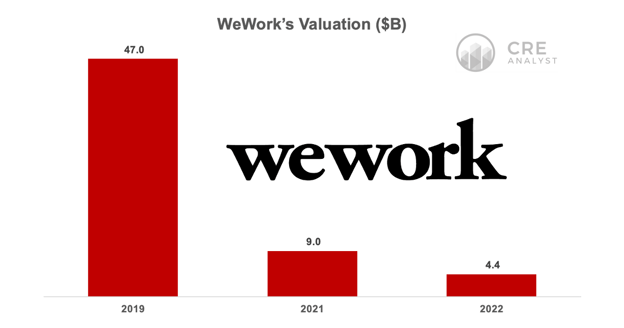

WeWork is a shadow of its former self, fighting for survival, and we see a big restructuring in 2022.

Softbank famously valued WeWork at $47 billion in 2019. WeWork kicked the can after the Adam Neuman debacle by SPAC-ing into a $9 billion company, but the firm is burning cash. It will be difficult for WeWork to kick the can beyond 2023.

COMMENTS